The modern agricultural landscape must reconcile growing global demand, changing climate patterns, and evolving market dynamics. In this context, the integration of biostimulants into cropping systems is emerging as a pragmatic innovation with the potential to enhance plant health, improve resource-use efficiency, and influence market outcomes. This article examines the role of biostimulants in improving crop performance, explores how they intersect with agricultural markets and farming practices, and outlines the opportunities and challenges for widespread adoption.

Understanding biostimulants and their modes of action

Biostimulants are a diverse group of substances and microorganisms applied to plants or soils with the aim of enhancing physiological processes, independent of their nutrient content. Unlike fertilizers or pesticides, biostimulants do not primarily supply essential nutrients or control pests; instead, they modulate plant metabolism, root growth, and stress responses. The product classes include seaweed extracts, humic and fulvic acids, protein hydrolysates, amino acids, silicon, and microbial inoculants such as beneficial bacteria and fungi.

Physiological and biochemical effects

- Stimulation of root architecture and growth, increasing the effective root surface area for water and nutrient capture.

- Enhanced nutrient uptake efficiency via chelation, root exudate modulation, or improved transporter expression.

- Modulation of hormonal pathways (e.g., auxins, cytokinins, abscisic acid) leading to improved growth and development.

- Activation of defense pathways that mitigate the impact of abiotic stress such as drought, salinity, and temperature extremes.

- Influence on the rhizosphere microbiome, which can indirectly improve plant nutrition and disease suppression.

These modes of action can occur concurrently and produce synergies that translate into improved yield, enhanced produce quality, and increased crop resilience.

Biostimulants in agricultural markets and farm systems

The commercial landscape for biostimulants has expanded rapidly over the past decade. Demand is driven by growers seeking inputs that can complement reduced fertilizer regimes, meet sustainability goals, or add value through improved crop uniformity and shelf life. Market segmentation shows strong interest in high-value horticulture, organic production, and regions facing chronic soil degradation.

Market drivers and economics

- Regulatory shifts and public pressure for lower agrochemical footprints have increased interest in alternatives and supplementary products.

- Rising input costs (fertilizer and energy) motivate growers to adopt practices that improve profitability per unit of input.

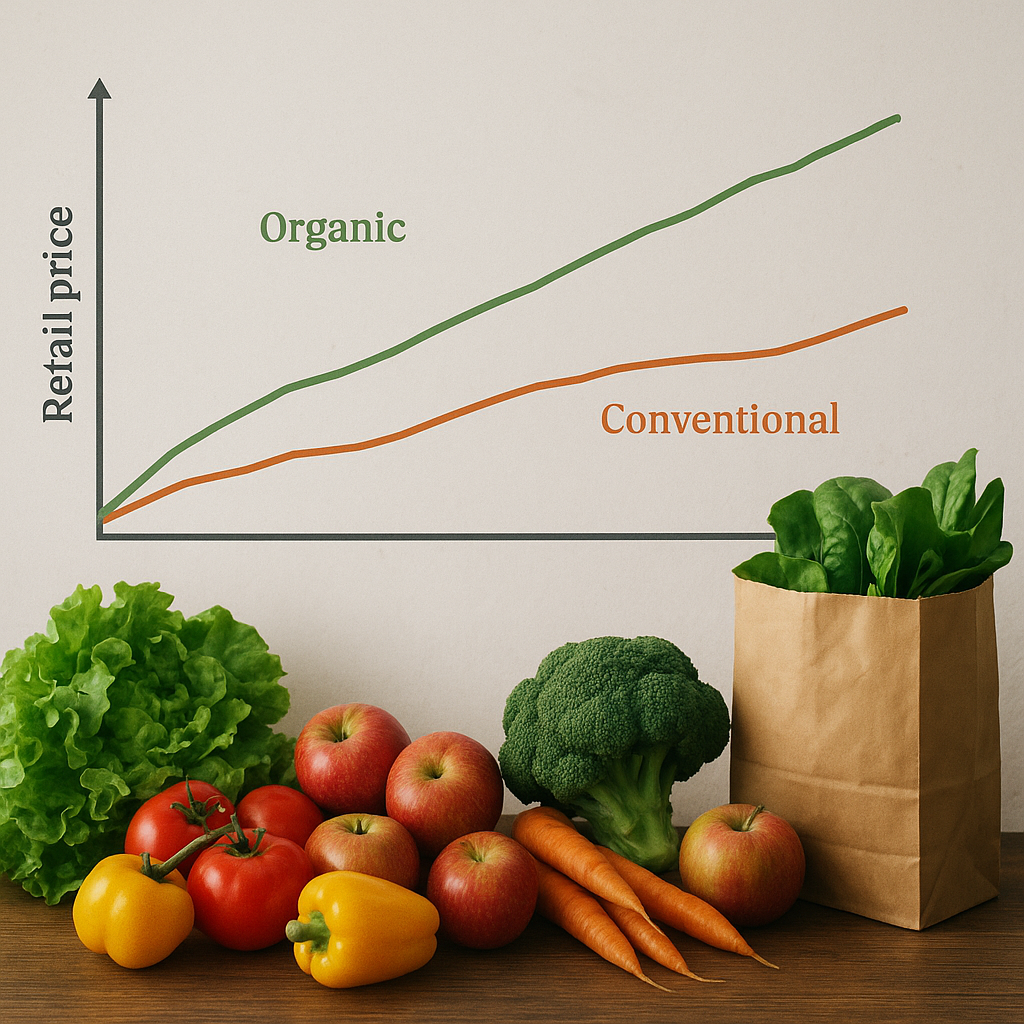

- Consumer demand for sustainably produced food creates price premiums for products labeled as environmentally friendly, indirectly incentivizing biostimulant use.

- Precision agriculture and data-driven management allow targeted application of biostimulants, optimizing return on investment.

However, market uptake varies by crop and geography. While vegetable, fruit, and specialty crop producers have been early adopters due to high margins and quality-sensitive markets, broadacre grain growers consider cost-effectiveness at scale and evidence of consistent yield benefits before committing to routine use.

Integration into farming practices

For farmers, biostimulants are most effective when incorporated into a holistic management plan. Key considerations include:

- Compatibility with existing fertilizers and crop protection products to avoid antagonistic interactions.

- Choice of application timing — seed treatment, soil application, or foliar spray — tailored to crop phenology and stress windows.

- Adoption of diagnostic and monitoring tools to measure efficacy, such as soil tests, tissue analysis, and remote sensing for early stress detection.

- Economic analyses that compare the cost of products and application against measurable gains in yield, quality, or reduced input needs.

Scientific evidence, regulatory context, and adoption barriers

Robust science and clear regulations play pivotal roles in building grower confidence and enabling broader biostimulant markets. Research has demonstrated benefits under many conditions, but variability in results is common due to product heterogeneity, environmental factors, and application inconsistencies.

Evidence base and research needs

Field trials and controlled studies have shown improvements in water stress tolerance, nutrient use efficiency, and post-harvest quality across several crops. Notable areas requiring further research include:

- Mechanistic studies that link specific molecular and microbiome changes to observed agronomic outcomes.

- Large-scale, multi-site trials to quantify performance across soil types, climates, and management systems.

- Long-term studies assessing cumulative effects on soil health, carbon sequestration, and ecosystem services.

- Economic modeling to determine the conditions under which routine application becomes financially beneficial.

Regulatory environment

Regulations governing biostimulants differ by jurisdiction. Some regions treat them as fertilizers with simplified registration, while others develop dedicated categories recognizing their unique functions. Clear labeling requirements and standardized efficacy claims are needed to prevent misleading marketing and to help growers make informed decisions. Harmonization efforts and science-based criteria would facilitate international trade and manufacturer investment in product validation.

Adoption barriers

- Product heterogeneity: Varied formulations and inconsistent active ingredient concentrations complicate selection and dosing.

- Knowledge gaps: Many growers and advisors lack experience with timing, modes of action, and measurement of benefits.

- Cost concerns: Upfront costs for high-quality biostimulants or repeated applications can deter adoption without demonstrated ROI.

- Supply chain issues: Access to reliable products and technical support is uneven across regions, especially in emerging markets.

Practical applications and case examples

Biostimulants show particular promise in several practical contexts where conventional inputs alone are insufficient for optimal performance.

Seed treatments and seedling vigor

Applying protein hydrolysates or beneficial microbes as seed coatings can improve germination rates and early root development. Strong early vigor often translates into better competition against weeds and improved stand uniformity, which is valuable for mechanized harvests and quality-sensitive markets.

Drought management and water-limited environments

Seaweed extracts, silicon products, and specific rhizobacteria have been associated with improved water retention, stomatal control, and osmoprotectant accumulation. In semi-arid regions, these effects can reduce yield variability and increase resilience to intermittent drought, stabilizing farm income across variable seasons.

Enhancing nutrient efficiency

Combining biostimulants with reduced fertilizer rates can maintain yields while lowering input costs and environmental losses. For instance, humic substances may increase phosphorus availability in low-solubility soils, and mycorrhizal inoculants can expand root access to immobile nutrients.

Quality and post-harvest benefits

Horticultural producers report improvements in fruit sugar content, color, and shelf life when using targeted biostimulant regimes. Quality gains translate directly to market value, making these products particularly attractive for high-value supply chains.

Interactions with sustainability goals and environmental impacts

Biostimulants can contribute to several sustainability objectives when used appropriately. They offer pathways to reduce synthetic fertilizer use, mitigate greenhouse gas emissions associated with fertilizer production, and enhance soil organic matter through increased root biomass and microbial activity.

- Lowered nutrient runoff potential through improved nutrient uptake and retention.

- Potential to support reduced tillage and conservation agriculture by improving root systems and biological soil functions.

- Enhanced biodiversity in the rhizosphere, which can suppress soil-borne pathogens and reduce reliance on chemical controls.

Nevertheless, sustainability outcomes depend on the source and manufacturing footprint of biostimulant products. Life-cycle assessments should be part of product development to ensure net environmental benefits.

Future directions: innovation, policy, and market evolution

As knowledge accumulates, the biostimulant sector is poised for maturation. Future innovation areas include formulation technologies that improve shelf life and compatibility, microbial consortia designed for specific agroecosystems, and digital decision-support tools that prescribe precise application timing and rates.

Policy and standardization

Policymakers can accelerate responsible adoption by:

- Creating clear, science-based product categories and labeling standards.

- Funding independent trials and public-private research partnerships to validate claims.

- Incentivizing practices that demonstrate measurable environmental benefits through payments for ecosystem services.

Market implications for supply chains

Supply chain actors — from input distributors to retailers and processors — will play a role in mainstreaming biostimulants by educating growers, bundling products with agronomic services, and incorporating biostimulant performance data into quality assurance programs. Traceability and certification schemes that recognize sustainable input use can help differentiate produce in competitive markets.

Practical guidance for growers considering biostimulant adoption

Growers interested in integrating biostimulants should follow a structured approach:

- Start with small, well-documented trials on representative fields to assess local performance under real-world conditions.

- Record application timing, rates, environmental conditions, and yield/quality metrics to build an evidence base.

- Work with extension services or reputable agronomists to select products matched to crop needs and soil constraints.

- Consider the product’s formulation, storage requirements, and compatibility with existing tank mixes and equipment.

- Evaluate the economic case using conservative estimates of benefit and factoring in reduced input costs or improved marketability.

Successful integration often requires patience and a willingness to adopt integrated management practices rather than viewing biostimulants as silver bullets.

Concluding observations on market and agronomic potential

Biostimulants represent a versatile set of tools that can support modern agriculture’s twin goals of productivity and sustainability. When backed by sound science, appropriate regulation, and farmer-centered service models, they can improve crop performance in measurable ways — increasing yield, enhancing produce quality, boosting resilience to stress, and improving input-use efficiency. Their role in agricultural markets will continue to evolve as evidence grows, supply chains adapt, and policy frameworks encourage responsible innovation that enhances both farm-level returns and environmental outcomes.