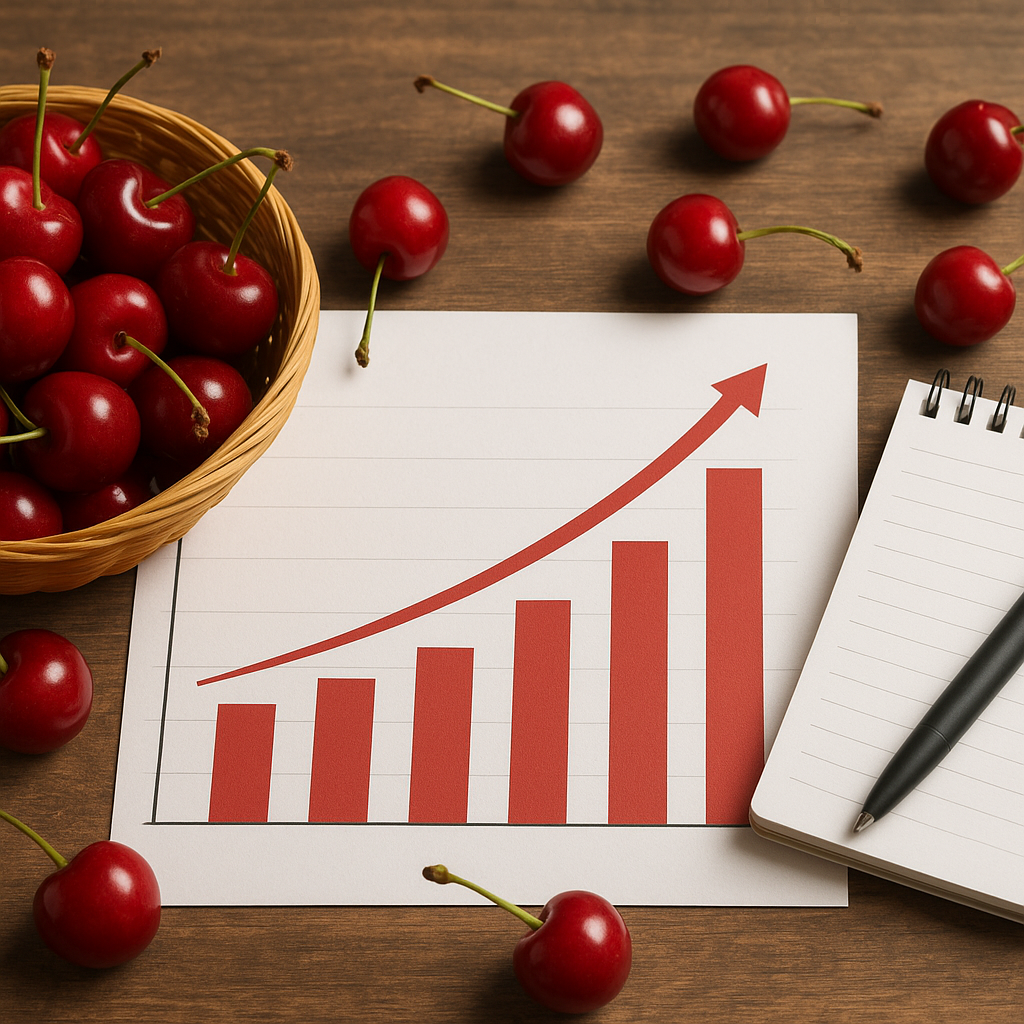

The global market for frozen fruit is evolving rapidly as consumers seek convenient, nutritious and year-round access to fresh flavors. This article explores the dynamics of agricultural markets related to frozen fruit, the production and processing considerations that shape competitive advantage, and the practical export opportunities available to producers and processors. Across regions, shifting consumption patterns and improvements in logistics create openings for value-added suppliers who can meet stringent standards while managing costs and risks.

Global demand dynamics and consumer trends

Worldwide demand for frozen fruit has been driven by several intersecting trends. Urbanization and busier lifestyles increase the appeal of convenient, ready-to-use ingredients for home cooking and foodservice. Health-conscious consumers favor fruit as a source of vitamins, fiber and antioxidants, and frozen formats often retain nutritional value comparable to fresh. Seasonal limitations and climate variability make frozen fruit a reliable supply for manufacturers and retailers throughout the year.

Key consumer drivers include:

- Preference for convenience in home meal preparation and smoothies.

- Increased consumption through foodservice channels, including bakeries, cafes and institutional buyers.

- Growth of frozen fruit use in industrial applications: ingredients for drinks, confectionery, dairy and prepared foods.

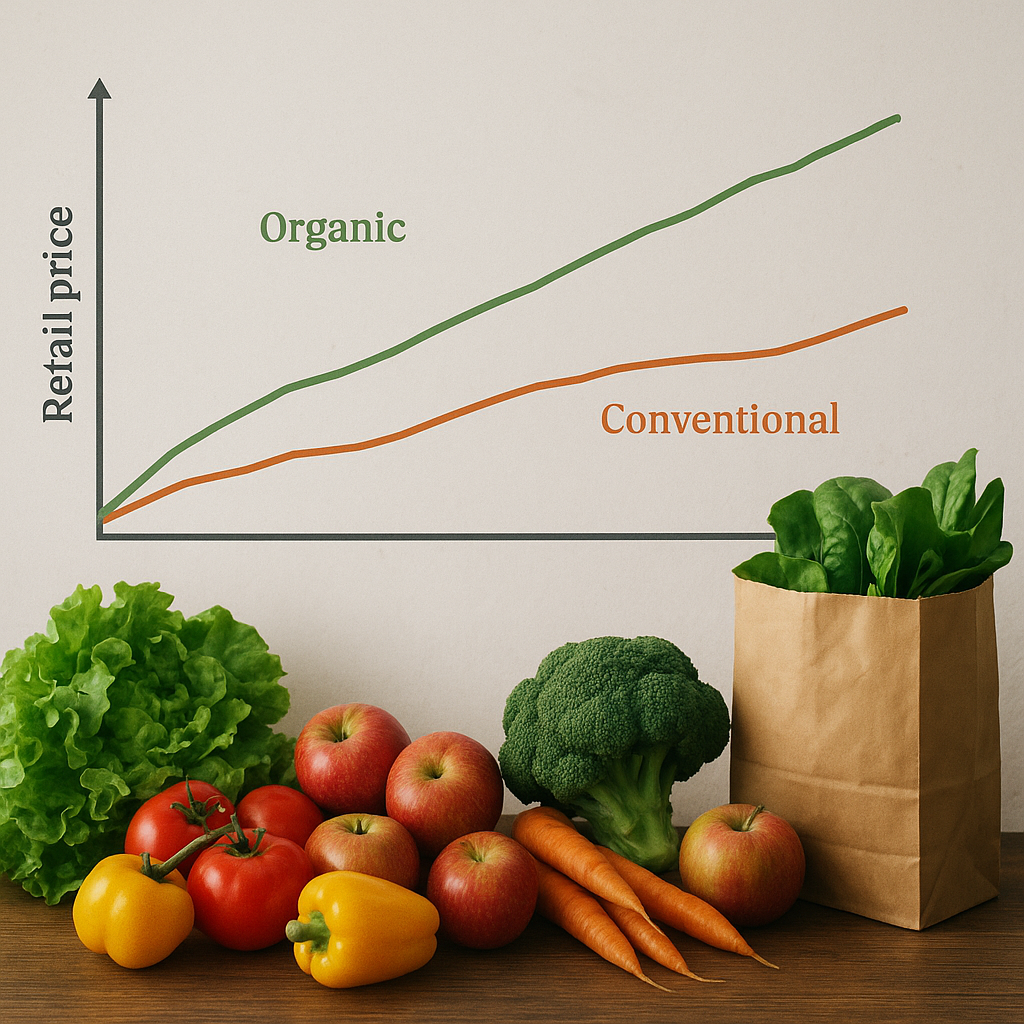

- Rising interest in organic and sustainably produced options, which command premium prices.

Demographic and channel shifts matter. Younger consumers adopt new flavor combinations and ethnic fruits more readily, supporting diversification of product portfolios. E-commerce continues to expand grocery reach, benefiting frozen categories when last-mile cold logistics are solved. Retail private labels and branded products coexist, creating space both for high-volume commodity suppliers and niche exporters who emphasize provenance and quality.

Production, processing and supply chain considerations

Moving fresh fruit into a frozen, marketable product requires coordination across farm production, post-harvest handling, processing and temperature-controlled logistics. The choice of freezing technology (IQF, blast freezing, cryogenic freezing) and pre-processing steps (washing, sorting, blanching, sugar infusion or concentrates) has implications for texture, color and nutrient retention.

On-farm practices and aggregation

Producers aiming for export need consistent sizing, ripeness management and integrated pest practices to meet maximum residue levels. Smallholders benefit from aggregation models—cooperatives or packer contracts—that centralize quality control. Investments in rapid field-to-freezer timelines minimize deterioration and preserve marketable yield.

Processing and packaging

Processors must balance capacity utilization with flexibility. Modern lines equipped for innovation—such as multi-fruit blends, purees, IQF berries, and portion-ready packs—can access higher-margin segments. Packaging innovations (vacuum-sealed pouches, resealable bags, recyclable films) extend shelf appeal and address retailer sustainability requirements.

Cold chain integrity is essential. A robust supply chain and reliable cold chain reduce losses and litigations over quality. For exporters, understanding the temperature profile needed for specific fruits (e.g., berries versus mango cubes) and designing logistics—refrigerated trucking, reefer containers, and cold storage at ports—is non-negotiable.

Export opportunities: target markets and market access

Export prospects depend on matching product specification to market demands and regulatory environments. High-potential destinations typically include the European Union, the United States, China, Japan, and parts of the Middle East and North Africa. Each market has distinct consumer preferences and compliance requirements.

Regulatory landscape and standards

Understanding sanitary and phytosanitary measures, customs procedures and quality standards is a first-order requirement. Common certifications sought by large buyers include certification schemes such as GlobalG.A.P., HACCP, BRC, and organic labels. Compliance with pesticide residue limits, traceability demands, and labeling rules determines market eligibility and reduces rejection risk.

- European Union: strict MRLs and packaging/labeling rules, preference for organic and sustainably certified goods.

- United States: FDA and USDA regulations, demand for consistent commodity-grade IQF berries and tropical fruit ingredients.

- China: growing demand for safe, premium imported ingredients; import permit and inspection systems apply.

- Middle East: strong demand for long-shelf frozen fruits in retail and foodservice with opportunities for value-added blends.

Market entry strategies

Successful exporters often adopt a combination of approaches:

- Partnering with established distributors or co-packers in target markets to leverage existing cold storage and retail relationships.

- Supplying private-label programs for large retailers who prioritize cost and reliable volumes.

- Focusing on niche, premium segments—organic, fair trade, single-origin or exotic fruits—for higher margins.

- Developing B2B relationships with manufacturers in the beverage, confectionery and dairy industries for bulk ingredient sales.

Pricing strategies must account for landed cost: production, value-add processing, freight (sea vs air), insurance, tariffs and handling. Containerized reefer shipping is cost-effective for volume shipments, while air freight suits high-value urgent consignments. Exporters should also plan for payment terms, letters of credit, and risk mitigation such as export credit insurance.

Value chain finance, organization and risk management

Access to finance for post-harvest infrastructure—cold stores, freezers, processing lines—remains a bottleneck for many producers. Public-private partnerships and development finance can catalyze investments that enable export volumes. Producers organized in cooperatives or under contract farming models gain bargaining power and can share fixed costs through centralized processing.

Risk management covers production variability, price swings and logistical disruptions. Practical measures include:

- Diversifying product lines across fruit types and markets to smooth revenue.

- Investing in insurance products and forward contracts where available.

- Implementing quality management systems to reduce rejections and claims.

- Developing contingency plans for cold chain failures and port delays.

Sustainability, traceability and technological trends

Environmental and social sustainability increasingly influence buyer decisions. Investments in water-efficient irrigation, integrated pest management, renewable energy for cold storage, and waste valorization (e.g., fruit fiber into animal feed) can improve margins and market acceptability. Many importers seek proof of responsible sourcing and transparent supply chains.

Traceability systems—ranging from batch coding to blockchain-enabled records—help demonstrate provenance, food safety history and carbon footprint. Traceability supports rapid recalls and builds consumer trust, particularly in premium markets. Digital tools that monitor temperature during transit, provide real-time alerts and automate compliance documentation reduce operational risk and improve service levels.

Technological advances are reshaping competitiveness:

- Improvements in quality analysis via near-infrared spectroscopy allow on-site sorting and grading.

- Automation in packing lines increases throughput and lowers labor dependency.

- Advanced freezing methods and cryogenic technologies preserve texture and color, expanding application possibilities.

- Data analytics help forecast demand, optimize inventory and reduce waste.

Practical recommendations for producers and exporters

Smaller producers seeking to enter or scale in the frozen fruit export market should consider a staged approach:

- Start with a clear market study to identify product-market fit, buyer specifications, and competitor pricing.

- Secure reliable aggregation and quality control mechanisms—sorting, cold holding, and sanitary processing.

- Pursue relevant certification early if targeting premium markets; certifications often take time and cost resources to obtain.

- Invest in a robust supply chain and maintain strict cold chain protocols to minimize quality deterioration.

- Explore partnerships with processors who can provide value addition and help meet volume and specification requirements.

- Use digital traceability and documentation platforms to facilitate customs and buyer audits.

For policy makers and sector sponsors, supporting cluster development—where processing, cold storage and logistics providers co-locate—can reduce per-unit costs and attract buyers. Capacity building in quality management, export procedures and sustainable farming practices raises the overall competitiveness of regional supply.

Outlook and strategic priorities

The frozen fruit sector will continue to expand where suppliers combine reliable production, strong quality assurance and market-facing product development. Climate variability will shape crop availability and drive investments in resilient varieties and post-harvest handling. Markets that reward sustainability and traceable sourcing will increasingly differentiate themselves, offering price premiums to suppliers who can demonstrate impact reductions and social responsibility.

Long-term success in frozen fruit exports rests on aligning farm-level practices with industrial processing needs, investing in the cold chain, and adopting technologies that ensure product integrity and meet evolving consumer expectations. With targeted strategies and partnerships, producers in diverse regions can capture a growing share of global demand by delivering consistent, high-quality frozen fruit to manufacturers, retailers and consumers worldwide.