The rapid expansion of organic agriculture over the past decade has reshaped many corners of the global food system. As more hectares are converted, new supply chains form and traditional market relationships are reconfigured. This article examines how a booming organic production base affects retail prices, exploring the interaction between farm-level changes and consumer markets, the role of certification and regulation, and the broader implications for sustainability, equity and market resilience. The analysis draws on economic theory, observed market patterns and practical examples to explain why increases in organic output do not always translate directly into lower prices at the checkout.

Market dynamics and the supply-side transformation

The most immediate consequence of expanded organic production is an increase in the quantity of organically produced commodities available to processors, wholesalers and retailers. However, the relationship between increased supply and retail pricing is mediated by several factors. Organic production typically entails different agronomic practices, input mixes and labor profiles compared to conventional farming. Transition periods, soil-building measures, crop rotations and crop losses associated with the conversion phase can temporarily reduce effective output per hectare even as planted area rises.

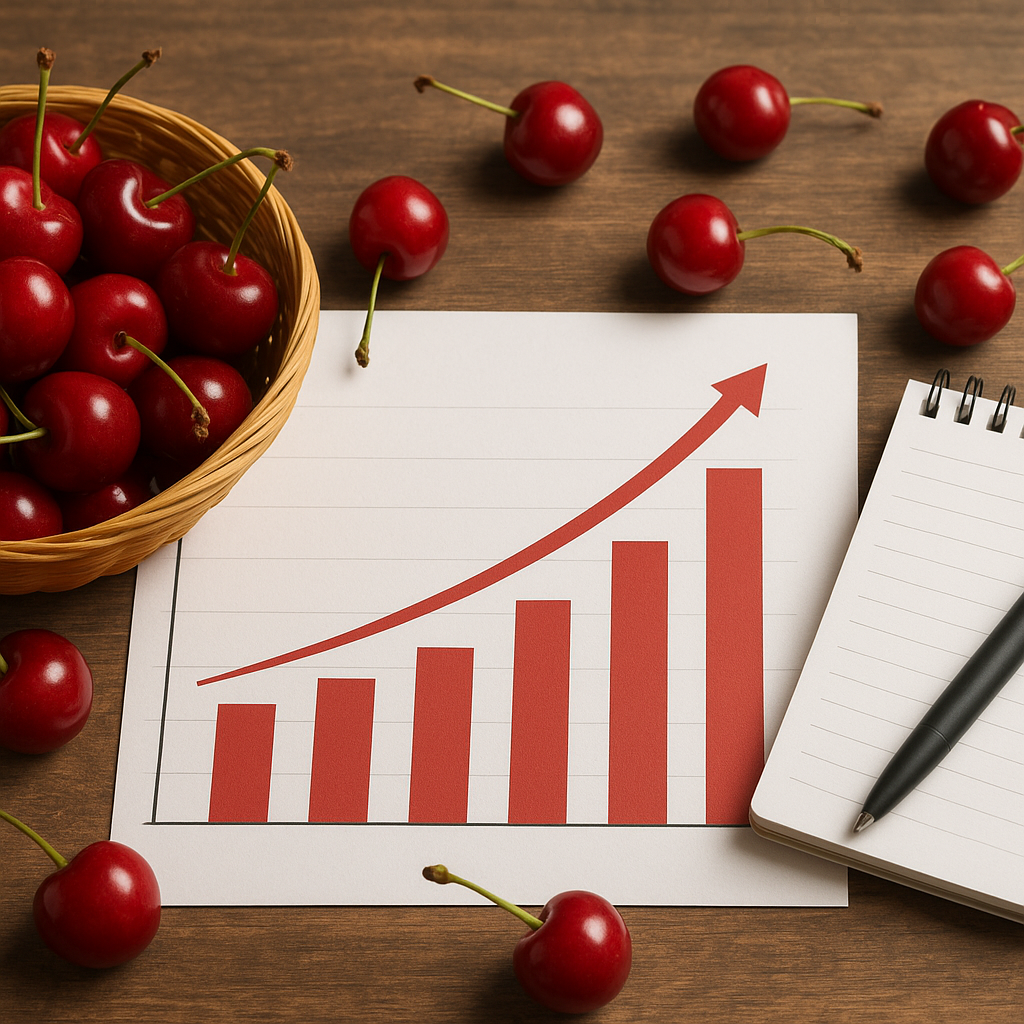

Investment decisions by farmers are influenced by expected price differentials and perceived market stability. When producers convert to organic, they expect to capture a premium over conventional goods. If new entrants flood the market quickly, farm-level prices may compress before demand has expanded sufficiently, pressuring margins. Conversely, if processors, distributors and retailers face bottlenecks in scaling up logistics, the farm-gate benefits may not reach consumers as reduced retail prices.

Scale economies in processing and distribution also matter. Many organic supply chains remain more fragmented than their conventional counterparts: smaller farms, diverse cropping systems and decentralized processing can increase per-unit costs. While some firms have invested in consolidation and automation that lower costs as volumes increase, these structural changes take time and capital. Meanwhile, increased organic acreage can improve bargaining power for manufacturers sourcing bulk organic commodities, but that power often translates into lower input costs for food processors rather than immediate retail price changes.

Price transmission from farm to retail

Understanding how farm-level shifts affect store prices requires tracing the price transmission mechanism through multiple intermediaries. Each stage—collection, processing, packaging, transportation, wholesaling and retail—adds costs and margin layers that can obscure raw commodity price movements. A decline in organic raw-material prices will sometimes be absorbed at the processor level to restore or maintain margins, rather than being forwarded to the consumer.

Three structural reasons explain imperfect transmission:

- Cost heterogeneity across supply chains: Organic certification, segregated handling and traceability systems raise fixed and variable costs. Even if commodity costs fall, these specialized logistics can keep retail prices elevated.

- Retailer pricing strategies: Retailers manage category perceptions; some maintain higher prices for organic lines to signal quality or to segment the market. Price reductions may be modest or slower to appear.

- Contracting and vertical integration: Long-term contracts at fixed prices or forward sales can delay the impact of changing farm prices. Conversely, vertically integrated firms that control multiple stages may choose to smooth consumer prices for brand stability.

Price volatility also plays a role. Organic markets can be more volatile because supply is influenced by biological constraints and because market participants react to price signals by switching practices. High volatility tends to be priced into retail goods through risk premiums, reducing the likelihood of rapid price declines even as overall supply grows.

Demand-side shifts and consumer segmentation

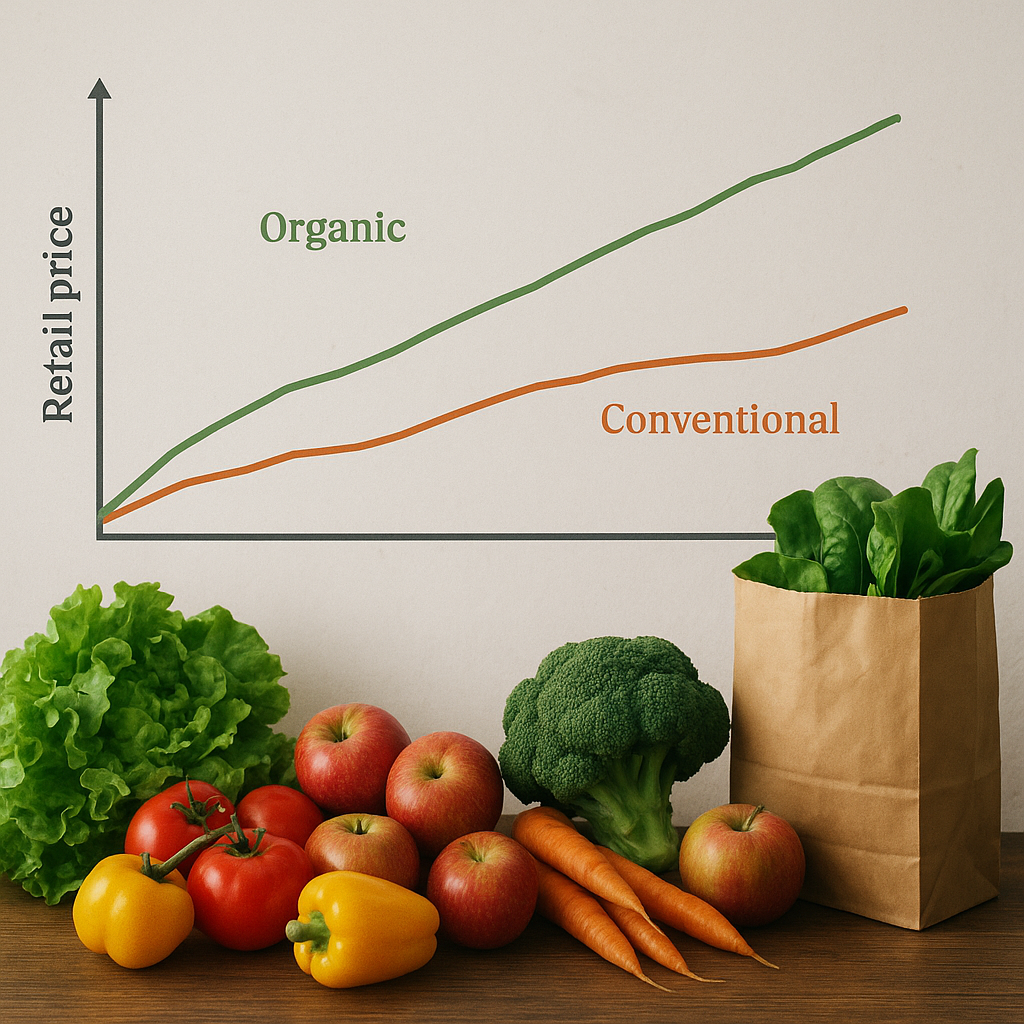

Retail pricing for organic products is fundamentally a balance between supply conditions and consumer willingness to pay. Growth in organic production frequently occurs alongside evolving consumer preferences: health concerns, environmental awareness, animal welfare considerations and food-safety perceptions all boost demand. When rising consumption absorbs additional output, retail prices may remain stable or even rise if demand growth outpaces supply.

Consumer heterogeneity matters. The organic market is comprised of segments with different elasticities of demand: from price-sensitive shoppers drawn by promotions to affluent buyers willing to pay consistently higher prices. Retailers layer pricing strategies across these segments, offering private-label organic lines at lower price points while keeping branded, premium organic items at a premium. The presence of discount retailers expanding their organic assortments can pull down prices in some subcategories, but high-end segments can sustain elevated prices.

Marketing and perception also influence price. If the broader narrative positions organic as a scarcity-linked, aspirational attribute, retailers will maintain premiums even as physical scarcity diminishes. On the other hand, transparent information about production increases and price competition among retailers can erode perceived scarcity and drive prices down.

Certification, standards and transaction costs

Certification regimes are essential to organic markets, assuring consumers about production methods. However, certification also introduces costs that complicate price dynamics. Certification fees, record-keeping, audits and compliance investments are fixed costs that must be amortized over production volumes. For smallholders, these costs can be a significant barrier and a persistent component of unit costs even as output grows.

When organic acreage expands primarily through consolidation—large farms converting and spreading certification costs over greater volumes—per-unit certification costs fall, creating room for lower retail prices. By contrast, expansion via many small-scale conversions may maintain high per-unit certification costs, keeping prices elevated.

International trade and equivalence agreements add complexity. Imported organic commodities from regions with lower production costs can depress domestic farm prices but may also raise questions about standards and traceability. Retailers respond by balancing price competition with assurances about provenance and compliance.

Environmental and agronomic trade-offs

A major driver of organic conversion is the promise of enhanced sustainability. Organic systems aim to reduce synthetic inputs, protect biodiversity and improve soil health. However, these outcomes interact with productivity and cost structures. In some crops, organic yields are lower than conventional yields, raising the unit cost of production. In others, improved management and crop rotations can narrow the yield gap over time.

Lower yields per hectare require more land to maintain the same overall output, with implications for land-use efficiency and commodity prices if demand remains constant. Conversely, innovations in organic agronomy and improved breeding for organic systems are progressively boosting yields, which over time can reduce unit costs and exert downward pressure on prices.

Externalities such as reduced water contamination or enhanced ecosystem services are not fully priced into markets. Therefore, while retail prices for organic products often carry a premium that reflects some of these benefits in consumers’ minds, most environmental gains remain public goods. Policy instruments—payments for ecosystem services or differentiated support—can alter the effective cost calculus for producers and indirectly affect retail pricing dynamics.

Policy, market design and governance

Public policy shapes both supply and demand for organic goods. Subsidies, conversion support, research funding and technical assistance can accelerate conversion rates and raise effective supply. Conversely, policy uncertainty or abrupt changes in support can create market oscillations. Trade policy, particularly tariffs and sanitary regulations, influences whether domestic expansion translates into greater retail availability or whether imports dominate.

Market governance—standards for labeling, enforcement of fraud prevention, and transparency in supply chains—also affect price behavior. Strong monitoring reduces the risk of market dilution by falsely labeled products, maintaining consumer trust and stabilizing the organic premium. Weak governance can create downward pressure on legitimate producers by flooding shelves with ambiguous or low-integrity products, altering price signals throughout the chain.

Impacts for stakeholders and strategic responses

Different stakeholders experience the impacts of booming organic production in distinct ways. Farmers face choices about scale, specialization and marketing channels. Processors and wholesalers must invest in segregation, traceability and potentially new processing lines. Retailers navigate assortment strategies, private-label development and promotional tactics. Consumers benefit from greater availability and potentially lower prices, but outcomes vary by product and region.

- Farmers can mitigate price pressure by diversifying crops, targeting value-added processing, or forming cooperatives to improve bargaining power.

- Processors should plan investments to capture economies of scale while maintaining flexibility for product differentiation.

- Retailers can use tiered strategies—combining value private labels with premium-brand offerings—to serve broader demographics without eroding margins.

- Policymakers can support fair transition by funding technical assistance, strengthening certification infrastructure and monitoring market integrity to protect both producers and consumers.

Strategic contracts, vertical integration and investment in supply-chain analytics can also improve price transmission and reduce waste. By matching seasonal supply with inventory strategies and diversifying sourcing, actors can smooth price swings and better align retail offers with consumer segments.

Outlook and evolving market patterns

As organic production continues to expand, retail prices will reflect an interplay of supply growth, consumer demand elasticity, certification costs and structural changes in supply chains. In many mature markets, increased scale and efficiency are likely to exert downward pressure on some retail prices, particularly for commoditized organic staples. At the same time, specialized, value-differentiated organic products—local, heirloom varieties, animal-welfare certified lines—are likely to retain strong premiums.

Innovation in logistics, digital traceability and direct-to-consumer channels may accelerate price adjustments by reducing transaction costs. Meanwhile, ongoing consumer education and shifting perceptions about value will continue to shape how much of any cost reduction is passed through to retail prices versus captured as margin.

Ultimately, the relationship between booming organic production and retail pricing is not mechanical. It is mediated by institutional arrangements, market power, certification regimes and consumer culture. Stakeholders who anticipate these complexities and invest in coordination, transparency and innovation are best placed to influence whether increased organic output translates into wider access, lower prices and more sustainable food systems.