The global landscape of sheep and lamb meat production is shaped by a complex interplay of ecological conditions, market forces, cultural preferences and technological advances. Producers, processors and policymakers respond to shifting demand patterns, trade dynamics and environmental constraints while attempting to maintain profitability and animal welfare. This article examines recent trends in production, the structure of agricultural markets, sustainability challenges and innovations that are redefining the sector.

Global production patterns and regional differences

Sheep and lamb production remains an important agricultural activity across diverse agro-ecological zones. While some regions specialize in extensive grazing systems on marginal lands, others rely on more intensive finishing systems to supply urban markets. The overall trend in many parts of the world has been a gradual consolidation of farms, with fewer but larger operations in countries where mechanization and feed-based systems are feasible. Conversely, in regions where sheep are integrated into smallholder mixed farms, the sector still supports livelihoods and food security for rural households.

Major producing and consuming regions

- China and South Asia: Large domestic consumption driven by cultural and regional preferences. Production systems vary from smallholder flocks to commercial operations.

- Oceania (Australia, New Zealand): Historically prominent in global exports, focusing on both live exports and chilled/frozen lamb meat for high-value markets.

- Europe (United Kingdom, Spain, France): Predominantly lamb-focused markets with high per-capita consumption in specific cultural contexts and strong niche markets for premium and seasonal products.

- Middle East and North Africa: Significant import demand for lamb for cultural and religious festivals, coupled with local pastoral systems.

- Sub-Saharan Africa and Latin America: Mixed impacts of increasing urbanization, variable investment in genetics and veterinary services, and pressure on grazing lands.

Differences in production systems affect both the quality and availability of meat. Extensive pasture-based systems often yield meat with distinct flavor profiles and lower input costs, while intensive systems can deliver consistent carcass weights and specific quality grades demanded by processors and retailers.

Market dynamics: supply chains, pricing and trade

Global markets for sheep and lamb meat are influenced by consumer preferences, trade policies, currency movements and feed costs. Seasonal demand spikes—around religious festivals in many countries and holiday seasons in others—create price volatility. Market integration has increased as cold-chain logistics improve, enabling more distant trade relationships.

Trade flows and market access

- Export-led suppliers such as Australia and New Zealand compete on scale and logistics efficiency, although competition from alternative proteins and other meats affects market share.

- Increasingly, exporters pursue value-added opportunities—such as premium chilled cuts and branded products—to capture higher margins rather than relying solely on commodity frozen shipments.

- Tariffs, sanitary and phytosanitary measures, and bilateral agreements shape access to lucrative markets. Producers must meet traceability and animal health standards to maintain market access.

Market participants must manage risk from exchange rate swings and commodity feed price cycles. Vertical coordination—through contracts between producers and processors—helps stabilize supplies and align incentives for consistent quality. Retail consolidation in some markets places bargaining power with large grocery chains, which sets technical and marketing requirements that producers must meet.

Sustainability, climate change and resource pressures

Environmental considerations are central to modern discussions about livestock production. Sheep systems range from low-carbon extensive grazing to higher-emission intensive finishing. Policymakers and consumers increasingly expect producers to demonstrate environmental stewardship, including low greenhouse gas emissions, biodiversity protection and sustainable pasture management.

Climate impacts and adaptation

- Climate change alters pasture productivity, water availability and the geographic suitability for different breeds. Droughts and heat stress can reduce lamb growth rates and increase mortality.

- Adaptive management includes rotational grazing, reseeding with drought-tolerant grasses, and water conservation measures. In some regions, producers are diversifying income with agroforestry or mixed livestock-crop systems.

- Carbon accounting and potential payments for ecosystem services are emerging as new income streams but require robust monitoring and verification.

Animal health and welfare intersect with sustainability. Better on-farm biosecurity, vaccination programs and parasite management reduce antibiotic use and losses, improving both productivity and consumer confidence. Integrated approaches also consider soil health and nutrient cycling; sheep can play positive roles in landscape management when stocking rates and grazing patterns are carefully managed.

Genetics, technology and productivity improvements

Genetic improvement programs and technology adoption are key levers for raising flock productivity and meat quality. Selective breeding for growth rate, carcass conformation, and resilience to disease or heat stress is gaining traction in many countries. Innovations in data-driven management and automation increasingly support decision-making on farms.

Technological trends

- Genetic tools: Marker-assisted selection and genomic evaluations enable faster gains for traits such as feed efficiency, meat yield and parasite resistance.

- Precision livestock farming: Sensors, weighing systems and shepherding drones help monitor flock health and reduce labor needs.

- Supply chain traceability: Blockchain pilots and digital ID systems improve transparency, enabling premium labeling for welfare-friendly or environmentally certified products.

Investment in research and extension services is crucial for translating innovations into widespread productivity gains, particularly among smallholders who may lack access to capital. Public-private partnerships and cooperative models can help disseminate best practices and genetic material across regions.

Policy, consumer trends and value chain evolution

Policy frameworks—ranging from trade agreements and veterinary regulations to environmental incentives—shape the competitive environment. Consumer preferences, especially in developed markets, increasingly value provenance, animal welfare and sustainability credentials. This shift influences how producers and processors position their products.

Emerging consumer and retail trends

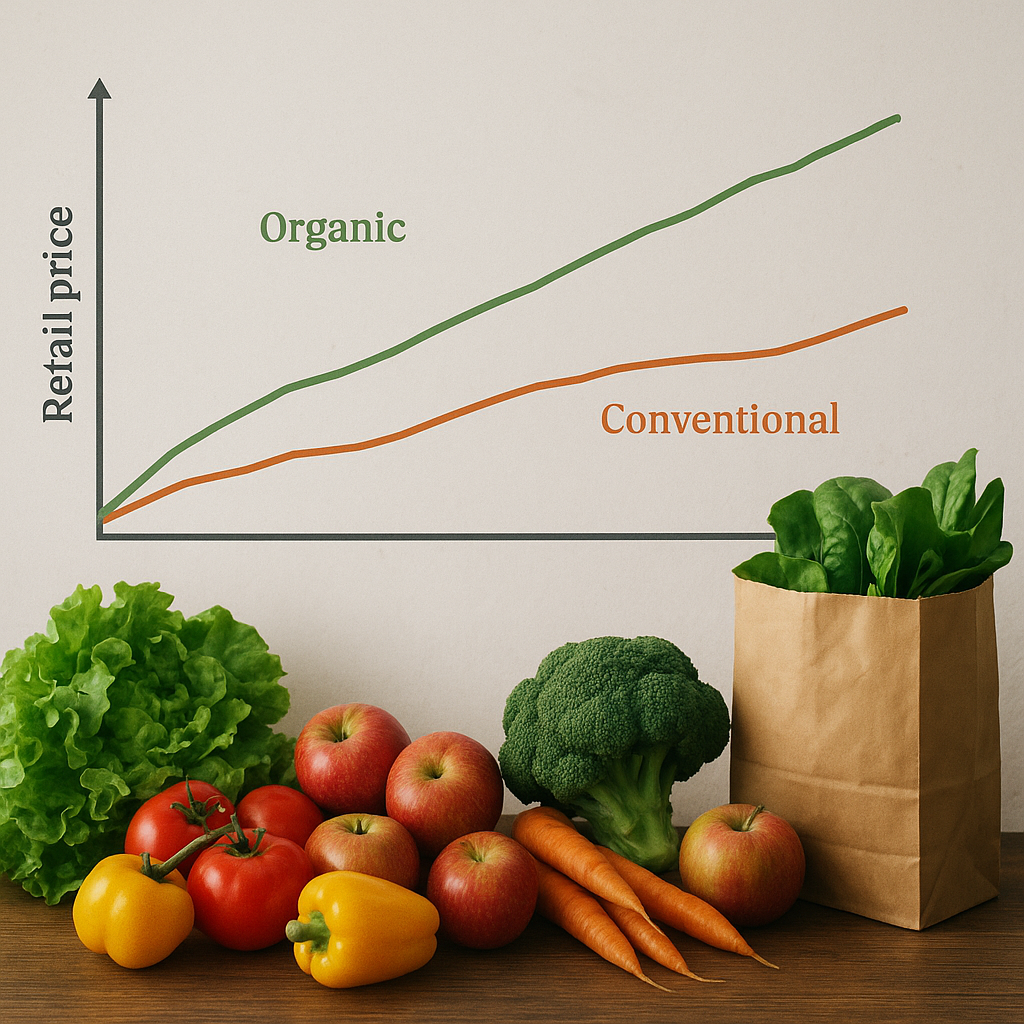

- Premiumization: Demand for high-quality, traceable lamb products supports niche markets such as organic, grass-fed or heritage-breed meat.

- Convenience and processed options: Pre-cooked or marinated lamb cuts are growing in urban markets where cooking time is limited.

- Competition from alternatives: Plant-based and cultured meat products introduce competitive pressure, prompting the industry to emphasize unique sensory and nutritional attributes.

Value chains are becoming more integrated and brand-driven. Producers who align with processors and retailers on quality standards, logistics and marketing can access higher-value channels. Cooperatives and contractual arrangements help smaller producers consolidate volumes and meet compliance requirements, strengthening their market position.

Challenges and opportunities ahead

The sector faces multiple challenges—volatile input costs, shifting trade policies, and environmental constraints—but also significant opportunities. Improving genetics and farm management can raise productivity while reducing emissions per unit of meat. Expanding access to export markets and developing niche brands offers pathways to higher returns. Strategic investments in veterinary services, extension and digital infrastructure will be critical to unlocking potential across both commercial and smallholder systems.

- Trade diversification: Reducing dependence on a few large markets can mitigate geopolitical and economic shocks.

- Value chain resilience: Building cold-chain capacity and processing infrastructure supports both domestic food security and export potential.

- Environmental markets: Participation in carbon or biodiversity schemes could create new revenue streams for sustainable producers.

- Consumer engagement: Transparent communication about welfare, origin and nutritional benefits strengthens market trust.

Ultimately, the future of sheep and lamb meat production will depend on how well stakeholders balance productivity goals with environmental stewardship and market responsiveness. Collaborative approaches that integrate science, policy and farmer knowledge can help the sector adapt to changing global conditions while contributing to rural livelihoods and food systems.