The global watermelon trade is a fascinating intersection of agriculture, commerce and consumer culture. This article explores how producers, exporters and retailers navigate the perennial challenges of growing, transporting and selling a highly perishable fruit. From smallholder farms to large agribusinesses, the determinants of profit in the watermelon market reflect broader trends in the supply chains of fresh produce, the pressures of seasonality, and evolving consumer preferences for quality and sustainability.

Market dynamics and demand drivers

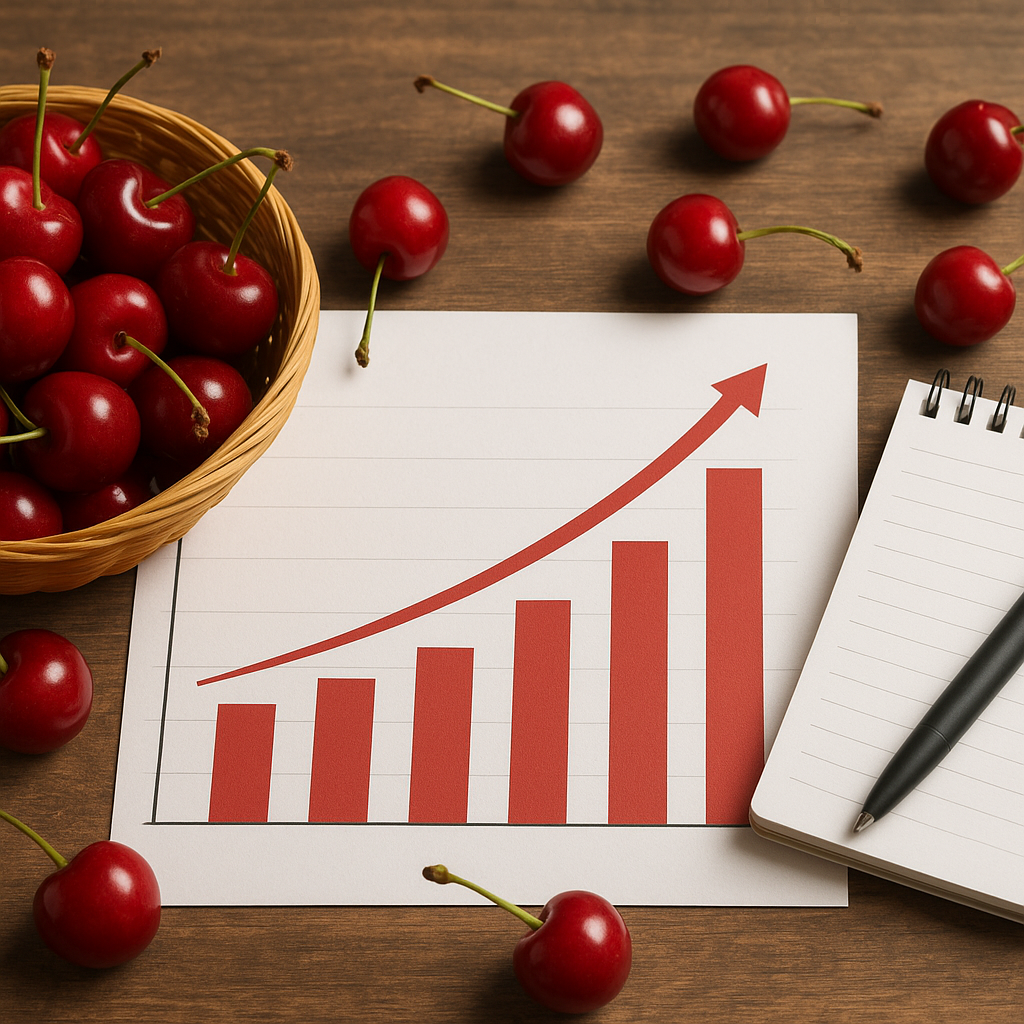

Watermelon occupies a unique position in the global fruit basket: it is inexpensive per kilogram, highly seasonal in many climates, and consumed en masse in both developing and developed countries. Demand is influenced by income levels, cultural practices (festivals, barbecues, summer holidays), and nutrition trends emphasizing fresh fruit. In recent years, rising urbanization and expanding retail chains have changed how watermelons are marketed and sold, increasing the role of standardized packaging and branding.

Key demand factors

- Income growth and changing diets in emerging markets.

- Temperature and weather patterns that drive seasonal demand spikes.

- Retail expansion and supermarket procurement practices.

- Food safety and quality concerns that shape consumer trust.

Price formation in the watermelon market tends to be local and time-sensitive. Short-term shocks—like a sudden heatwave or crop disease—can create rapid price swings because logistics and cold-chain limitations constrain supply flexibility. At the same time, longer-term trends such as population growth and agricultural innovation in varieties and cultivation techniques gradually reshape the supply side.

Production economics and cost structure

Understanding profit margins requires unpacking the cost structure of production. Watermelon farming ranges from labor-intensive small plots to large-scale mechanized operations, with costs varying accordingly. Key expense categories include land, labor, inputs (seeds, fertilizers, pesticides), irrigation, post-harvest handling, and transport. In many producing countries, labor is the single largest cost component due to planting, trellising, and manual harvesting.

Typical cost breakdown

- Seed and seedlings: investments in improved cultivars can raise yields and extend shelf life.

- Fertilizers and crop protection: essential for maintaining productivity but volatile in price.

- Irrigation and water management: increasingly important in arid producing regions.

- Labor: seasonal peaks during planting and harvest amplify wage pressures.

- Post-harvest handling and packaging: critical for reducing losses and meeting buyer specifications.

Producers who adopt improved agronomic practices—drip irrigation, integrated pest management, and better varietal selection—can increase yield and fruit quality, which supports higher farm-gate prices. However, these investments can be capital-intensive, raising barriers for smallholders. Access to credit, extension services and cooperative marketing arrangements therefore becomes essential for scaling profitability.

Trade, logistics and cold chain challenges

International watermelon trade involves complex logistics because the fruit is heavy, bulky and perishable. Transit time, handling, and temperature control significantly influence the proportion of harvest that reaches markets in salable condition. Exporters must balance packing density (to reduce shipping costs) with the risk of mechanical damage, which lowers market value. Cross-border trade is also affected by sanitary and phytosanitary (SPS) regulations and phytosanitary certification requirements.

Export routes and risks

- Short-distance regional trade often accounts for the majority of cross-border shipments.

- Long-distance shipments require faster logistics or air freight for high-value markets.

- Infrastructure bottlenecks—poor roads, limited cold storage—create post-harvest losses.

- Regulatory barriers and seasonal import restrictions can interrupt established flows.

In many producing countries, post-harvest loss rates are a significant drag on profitability. Investments in sorting, precooling and refrigerated transport reduce losses but add to the cost base, meaning exporters must secure premiums from buyers to justify the expense. The interplay between post-harvest efficiency and market access often determines whether producers can move beyond local markets into higher-paying export channels.

Price formation and margin distribution

Profit margins in the watermelon chain are distributed among farm-level producers, traders, transporters, wholesalers and retailers. The share captured at each step depends on market concentration, bargaining power, and the level of value-adding activities (like slicing, packaging, branding). In many markets, retailers and exporters with established distribution networks capture a disproportionate share of margins, while smallholder farmers receive only a modest proportion of the final retail price.

Factors shaping margins

- Market structure: concentrated retail sectors can exert downward pressure on farm-gate prices.

- Product differentiation: branded, seedless or pre-cut products command higher prices.

- Information asymmetry: lack of transparent price information disadvantages producers.

- Transaction costs: multiple intermediaries diminish net returns to farmers.

For producers to improve their margin, strategies include improving post-harvest quality, engaging in direct contracting with retailers or exporters, joining cooperatives to gain scale, and adopting varietal improvements that meet consumer preferences. Innovative business models—such as contract farming, outgrower schemes and digital marketplaces—are changing how margins are negotiated and shared.

Sustainability, climate risk and future challenges

Climate change poses long-term risks to watermelon production through altered rainfall patterns, higher temperatures, and increased pest and disease pressure. Sustainable practices—water-efficient irrigation, soil health management, and diversified cropping systems—can reduce vulnerability and lower input costs over time. Nevertheless, transitioning to sustainable systems often requires upfront costs and technical know-how, again highlighting the importance of extension services and supportive policy frameworks.

Environmental and social considerations

- Water scarcity in key producing regions intensifies competition for irrigation resources.

- Pesticide use and residue management are central to meeting export market standards.

- Labor conditions and seasonal migration affect social sustainability and reputational risk.

Buyers in developed markets increasingly demand documentation of sustainability practices, which can create a price premium but also increase compliance costs. Carbon footprints, water-use metrics and labor standards are becoming part of procurement criteria, nudging the industry toward more transparent and resilient business practices.

Opportunities: value addition and market segmentation

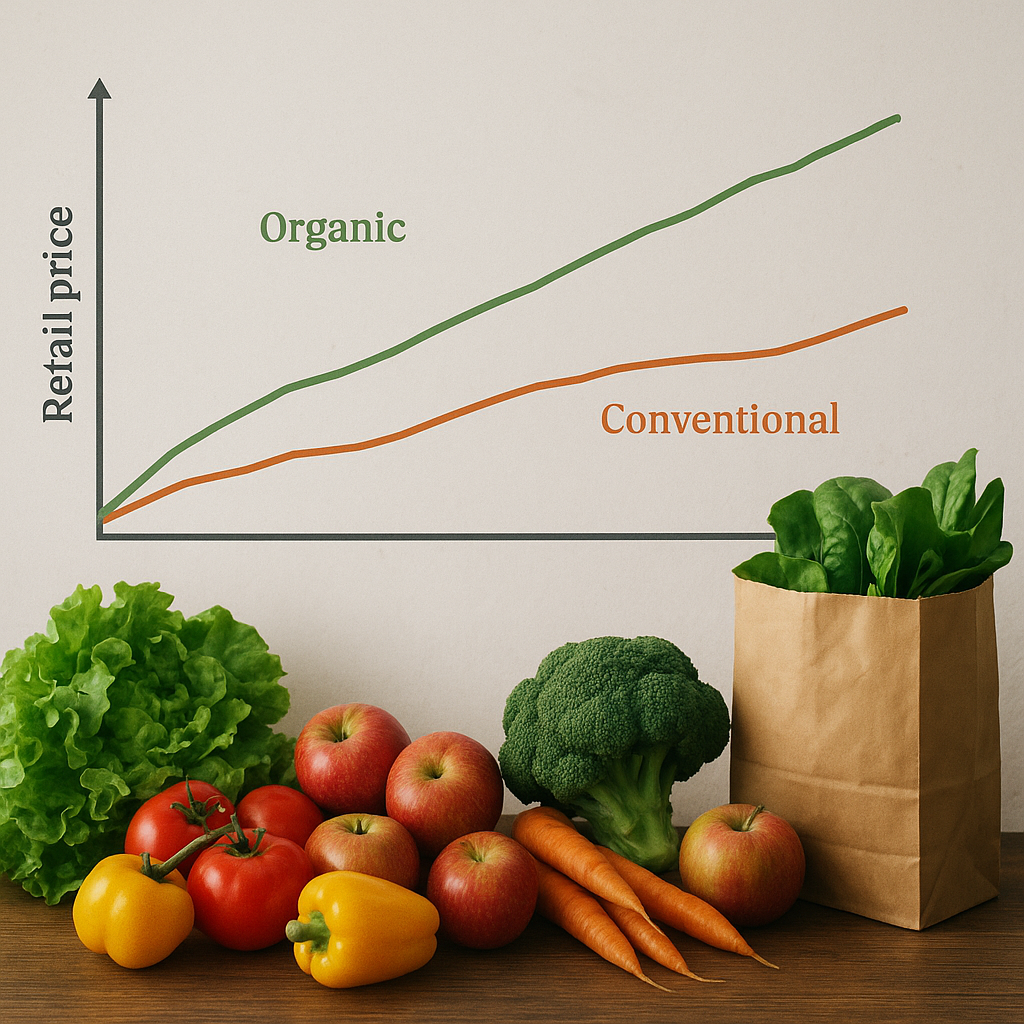

There is growing scope for value addition in the watermelon sector: seedless varieties, organic production, pre-cut and packaged fruit, and processed products (juices, powders, pickles) all open higher-margin channels. Urban consumers favor convenience and consistent quality, so investment in processing and cold-chain-enabled retail formats can capture willing buyers.

- Pre-cut watermelon in grab-and-go packaging maximizes retail margin per kilogram.

- Processing into juice, concentrates or dried pieces extends shelf life and creates industrial markets.

- Premium niche markets (organic, heirloom varieties) reward small-scale producers with quality focus.

Digital platforms and improved market intelligence also provide producers with pricing information and direct access to buyers. By shortening the chain and reducing intermediaries, digitalization can increase the producer share of the final price—assuming adequate logistics and trust mechanisms are in place.

Policy, finance and institutional supports

Public policy plays a crucial role in shaping profit margins across the watermelon sector. Investments in rural roads, electricity, cold storage and irrigation infrastructure lower transaction and post-harvest costs, enhancing competitiveness. Subsidies or credit programs for irrigation equipment, seed purchases, and cooperative formation enable farmers to adopt productivity-raising innovations.

Recommended institutional measures

- Targeted extension services to disseminate best practices and climate-adaptive techniques.

- Credit access and insurance schemes to smooth investment cycles and manage weather risk.

- Support for producer organizations to improve bargaining power and market access.

- Regulatory harmonization to facilitate regional trade and reduce SPS-related barriers.

When combined, these measures help stabilize yields, reduce losses and create more predictable profit streams. Ultimately, the ability of stakeholders across the chain to coordinate—through contracts, cooperatives and public-private partnerships—determines the extent to which value is captured within producing regions rather than being dissipated along the chain.

Conclusion

The global watermelon market offers a clear illustration of how agricultural profitability is shaped by biological, logistical and institutional factors. Producers who can reduce post-harvest losses, access reliable markets, and meet quality and food safety requirements improve their prospects for sustainable profits. Policies and investments that bolster infrastructure, extension and market transparency are essential to enable smallholders and commercial farmers alike to benefit from growth in demand. In a market defined by bulk volumes and thin margins, strategic value addition, improved quality control and efficient distribution are the levers that translate abundant harvests into lasting economic returns.