The interplay of weather patterns, consumer behavior and global trade shapes the prices of leafy vegetables in markets around the world. From smallholder farms to large commercial growers, the forces that push prices up or pull them down are complex and interdependent. This article examines the main economic drivers affecting leafy vegetable prices, explores how production and supply chain realities alter market outcomes, and considers policy, technological and sustainability trends that will influence future price dynamics.

Market dynamics and price formation

Leafy vegetables such as lettuce, spinach, kale and other salad greens are distinct from many staple crops because of their perishability, short harvest cycles and often high labor intensity. Price formation in markets for these crops depends on a mix of supply side and demand side factors, each subject to rapid shifts.

On the supply side, short-term shocks frequently create sharp price volatility. A single weather event—heavy rains, early frosts or heat waves—can reduce yields markedly and restrict availability for several weeks, driving prices up quickly. Conversely, an unexpected bumper harvest or the rapid opening of imports can flood a market and depress prices. Producers and traders must therefore manage a high degree of seasonality risk.

Demand patterns for leafy greens are shaped by consumer preferences, income levels and dietary trends. Rising health consciousness in many countries has increased steady demand for fresh vegetables, sometimes smoothing price cycles. However, demand can still be fickle: seasonal holidays, restaurant demand, and short-lived dietary fads (e.g., sudden popularity of certain salad varieties) contribute to spikes in sales that markets must absorb.

Price discovery often occurs through a combination of direct contracts between buyers and growers, spot market transactions at wholesale markets, and long-term arrangements with processors or retailers. Each mode alters how quickly and how far prices move in response to shocks. Spot markets transmit real-time shortages or gluts, creating high volatility, while contracts can insulate both parties but may perpetuate misaligned prices if conditions change unexpectedly.

Production, inputs and technology

Understanding production costs is central to explaining long-term price trends. Key cost drivers for leafy vegetable growers include labor, fertilizers and other agrochemicals, water and energy for irrigation, and investments in climate control such as greenhouses or shade structures. When input prices rise—say, due to increased global fertilizer prices—growers often need to raise their asking prices to maintain margins, unless they accept losses or reduce acreage.

Labor is particularly significant because many operations rely on labor-intensive tasks like transplanting, pruning and harvesting. Availability and cost of labor are influenced by migration patterns, minimum wage policies, and mechanization rates. Where mechanization is feasible, it can reduce unit labor costs and improve consistency, but the capital outlay and suitability for delicate crops vary.

Technological innovations are changing what is feasible in leafy vegetable production. Hydroponics, vertical farming and controlled-environment agriculture promise higher yields per square meter and more consistent year-round supply. These systems reduce exposure to weather risk and can lower transport distances by enabling production near urban centers, thereby reducing logistical costs and post-harvest losses. However, they often carry higher initial capital and energy costs, meaning their impact on prices depends on local energy prices and economies of scale.

- Advantages of controlled-environment systems: predictable yields, reduced pesticide use, proximity to urban markets.

- Constraints: capital and energy intensity, technical expertise requirements, and uncertainty over consumer willingness to pay premiums.

Supply chains, logistics and post-harvest handling

From field to fork, the supply chain for leafy vegetables is short but fragile. Because leaves bruise easily and lose freshness quickly, efficient logistics and cold chain infrastructure are critical to preserving value and avoiding waste. Gaps in transport, inadequate refrigeration, and slow wholesale handling can turn potential supply into unsellable product, tightening effective market availability and exerting upward pressure on prices.

Wholesale markets remain hubs of price formation, where many buyers sample, negotiate and purchase daily volumes. Consolidation in retail—supermarket chains and foodservice companies that purchase large volumes—has shifted some bargaining power away from small growers. These large buyers often demand consistent quality, traceability and certification, which increases production costs but can stabilize demand through contracts.

Logistics disruptions—port congestion, labor strikes, fuel price spikes—can rapidly inflate costs and margins along the chain. For perishable leafy vegetables, even modest delays can cause a significant loss of marketable quantity, pushing sellers to raise prices to cover higher effective per-unit costs. Conversely, investments in packhouses, rapid cooling, and cold trucks can reduce loss rates and contribute to more stable prices.

Post-harvest losses and market impact

Post-harvest loss rates for leafy vegetables are typically higher than for many durable crops. Reducing waste through improved handling and packaging has two price effects: it increases the effective supply available to markets (potentially lowering prices) and raises costs associated with better packing and technology (which may support higher prices to recoup investment). Policy incentives or private investments that lower losses thus have mixed but often net stabilizing effects on market prices.

Trade, policy and risk management

International trade plays a pivotal role in smoothing regional supply imbalances. When domestic production falls short, imports can meet demand—reducing price spikes. Yet, trade flows are influenced by tariffs, phytosanitary rules, transport costs and exchange rates. Protectionist measures, sudden export bans in supplier countries, or currency depreciation that makes imports costly can rapidly alter local price dynamics.

Local agricultural policies—subsidies, minimum support prices, insurance schemes and extension services—affect producer incentives and risk-taking. For example, subsidized inputs may encourage expanded production in a season, potentially leading to oversupply and lower prices later. Insurance and price support reduce downside risk for growers but may also encourage production patterns that do not align with market demand signals.

- Risk management tools: forward contracts, futures (limited for many leafy crops), crop insurance, and cooperatives that negotiate collectively.

- Regulatory tools: import quotas, sanitary standards, and food-safety regulations that influence market access and consumer trust.

Climate risk is increasingly central. Long-term trends such as changing rainfall patterns and increasing frequency of extreme events force reassessments of cropping calendars and varietal choices. Public investments in irrigation, drainage and climate-resilient seeds help stabilize supply, but require time and funding to implement.

Consumer trends and value chains

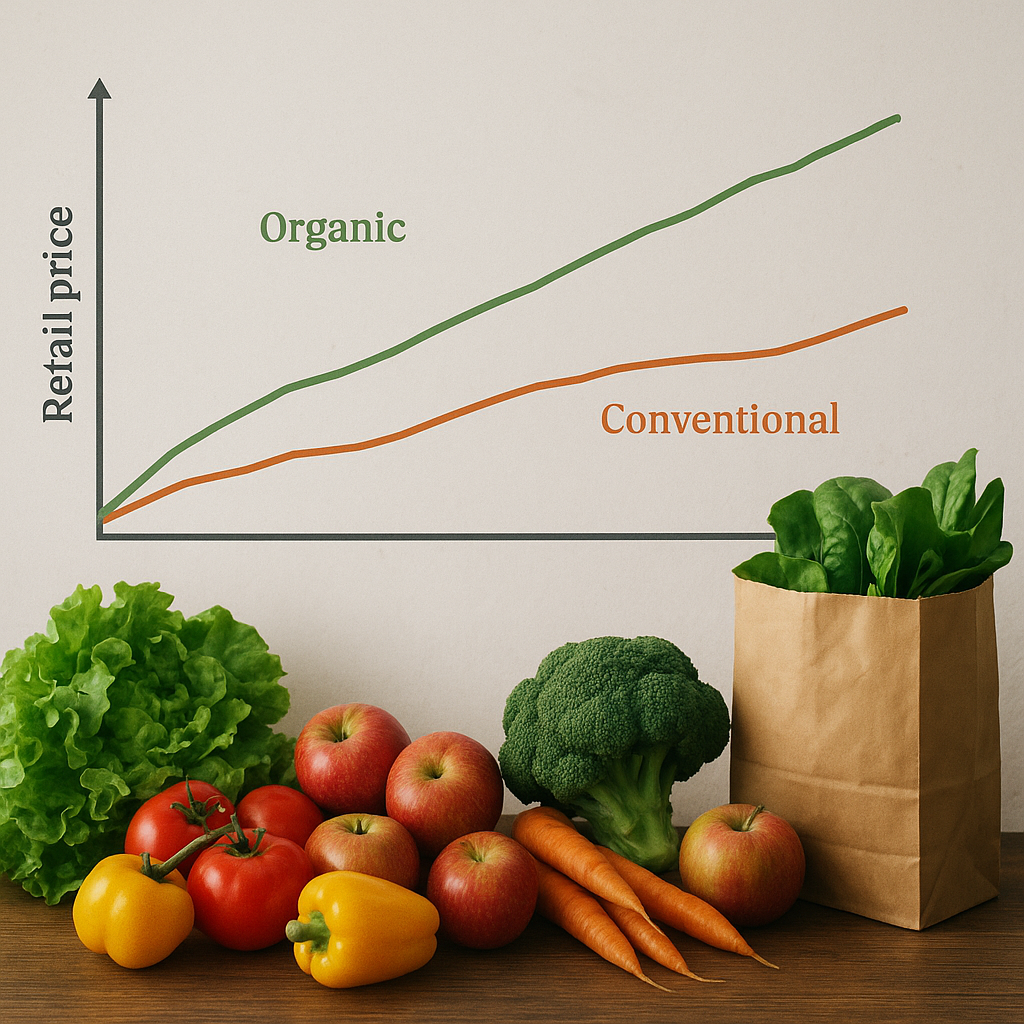

Demand for leafy vegetables is shaped not only by price and income but also by tastes, convenience, and perceptions of quality and safety. Growth in ready-to-eat salad mixes, for instance, has created value-added chains where washing, trimming and packaging add cost but also generate higher retail prices. Organic certification, local branding and sustainability claims can command price premiums, though the size of the premium depends on consumer segments and market maturity.

Retailers and foodservice providers increasingly differentiate products by attributes such as organic, locally grown, fair labor practices and minimal pesticide use. These attributes can protect price points when supply is plentiful, as some consumers will choose higher-priced options. However, such segmentation can leave conventional producers exposed to price competition if consumers become more price-sensitive during economic downturns.

Marketing and consumer education

Effective marketing and consumer education can shift demand toward underutilized leafy vegetables, smoothing market demand and offering growers more diverse outlets. Cooperative marketing, digital platforms that connect producers with urban consumers, and subscription-based delivery models (e.g., community-supported agriculture) help stabilize demand and provide price signals directly to growers.

Future directions and considerations

Several trends will shape future price dynamics for leafy vegetables. First, urbanization and changing diets will likely increase per-capita consumption in many regions, but distributional effects will vary. Second, investments in sustainability—water-efficient irrigation, integrated pest management, and reduced plastic usage—will alter cost structures and market positioning. Third, improvements in data, forecasting and market information systems can reduce mismatch between supply and demand, limiting extreme price swings.

Policymakers and private actors must balance incentives to increase production with measures that improve market access, reduce losses and ensure fair returns for producers. Encouraging cooperative models, supporting cold chain development, and facilitating adoption of low-energy controlled-environment methods are practical steps. At the same time, continued monitoring of trade policies and investment in climate adaptation will be essential to managing future volatility.

Overall, the prices of leafy vegetables reflect a tight interplay of biological constraints, logistical realities and evolving consumer expectations. Stakeholders across the chain—growers, traders, retailers, policymakers and consumers—can each influence price outcomes through choices about investment, behavior and regulation. By focusing on resilience, efficiency and market transparency, the sector can better withstand shocks and deliver nutritious greens to consumers at prices that sustain viable livelihoods for producers.