The rise of healthier diets and shifting consumer priorities is transforming agricultural landscapes and vegetable marketplaces around the world. As shoppers increasingly prioritize freshness, traceability and environmental responsibility, producers, distributors and policymakers are rethinking how food is grown, moved and sold. This article examines the forces behind evolving demand, the consequences for production systems, and the innovations reshaping the future of vegetable markets. It explores the economic, social and environmental dimensions of these changes and highlights practical strategies for stakeholders across the value chain.

Drivers of Change: Health, Preference and Purchasing Power

Several interlocking trends are accelerating changes in vegetable markets. Rising awareness of diet-related health outcomes is redirecting consumer spending toward plant-forward eating patterns. Urbanization and greater disposable income in many regions also increase demand for convenience and year-round availability. Digital platforms and social media have amplified nutrition guidance and culinary trends, magnifying the influence of chefs, nutritionists and influencers on consumption choices.

Shifts in dietary patterns

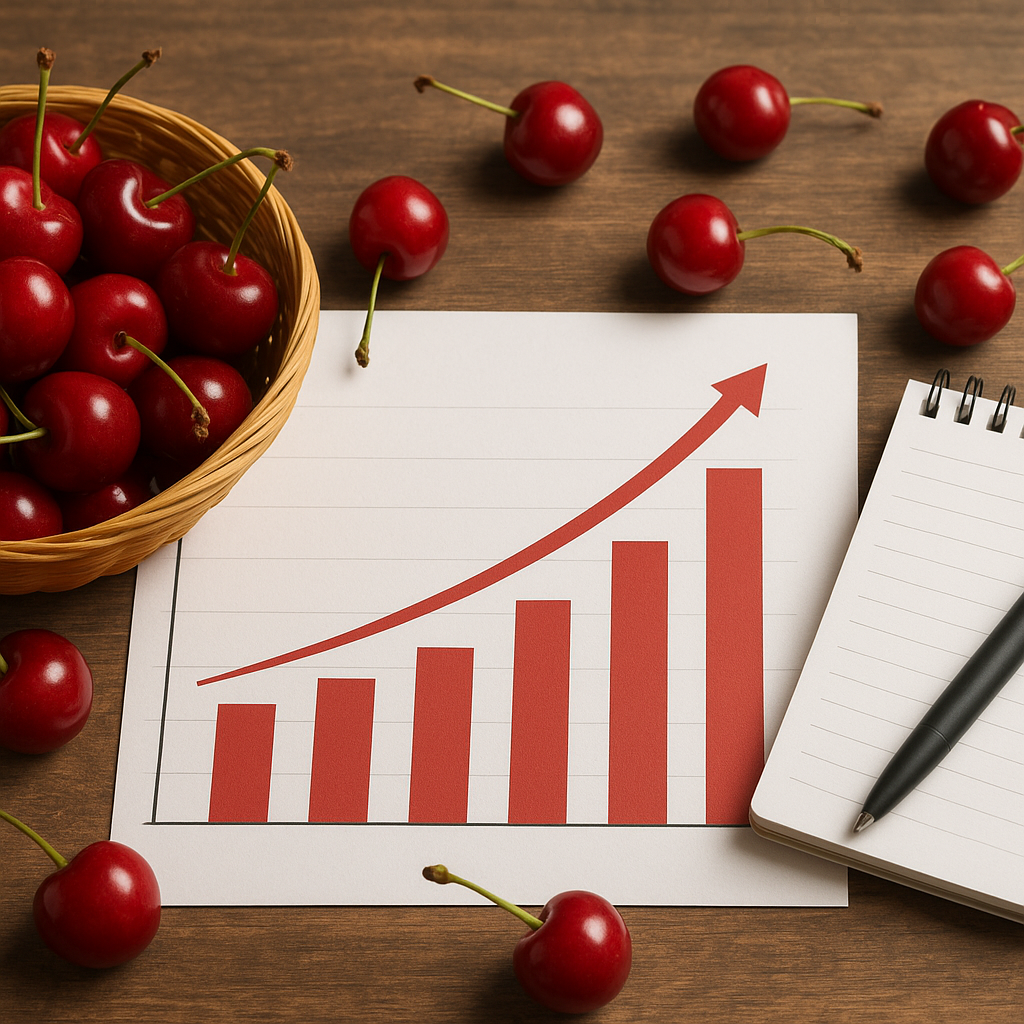

Consumers are embracing diets rich in vegetables for their perceived health benefits, including improved nutrition, weight management and chronic disease prevention. These preferences manifest in higher consumption of leafy greens, colorful vegetables, and minimally processed produce. Demand for specialty items such as microgreens, ethnic vegetables and pre-washed salad mixes has surged, pressuring traditional production systems to diversify and adapt.

Economic and demographic influences

Income growth and demographic change alter both what and how people buy. Younger cohorts value transparency and provenance, while older consumers may prioritize quality and safety. E-commerce and home delivery services enable access to a broader range of vegetables, increasing price sensitivity and raising expectations for consistent quality and fast delivery. As a result, markets must balance affordability with premium offerings.

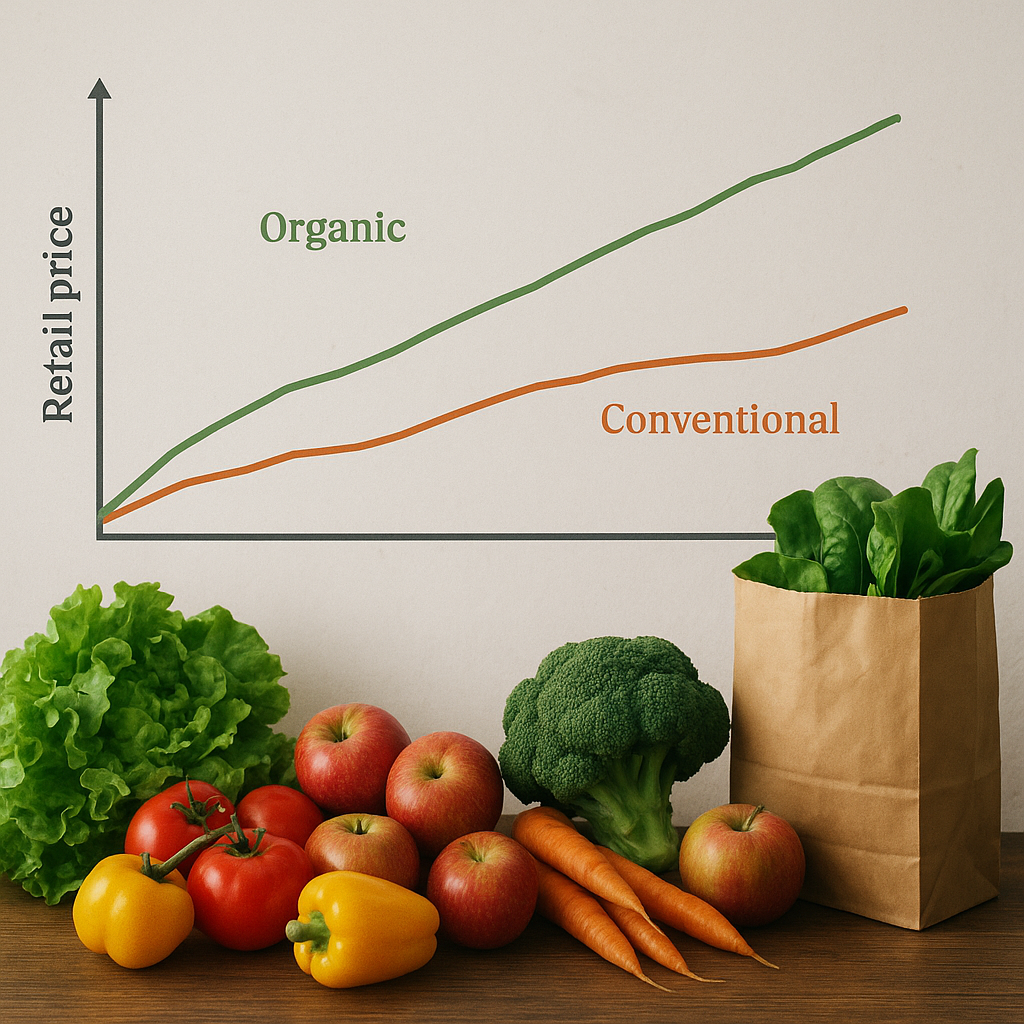

Environmental and ethical concerns

Environmental awareness steers many buyers toward products associated with lower ecological footprints. Consumers ask questions about pesticide use, water consumption, and greenhouse gas emissions connected to their food. Labels such as organic or carbon-neutral certifications become important signals, shaping purchasing behavior and encouraging producers to adopt more sustainable practices.

Production Responses: How Farmers and Growers Are Adapting

Farmers face both opportunity and disruption as demand landscapes shift. To meet consumer expectations, many producers are revising crop choices, investing in new technologies, and seeking closer connections with end markets. These adaptations span from diversification and intensification to improved marketing and risk management.

Crop diversification and variety development

Producers are diversifying beyond commodity vegetables to include high-value and niche crops that command better margins. Investment in breeding and seed selection targets varieties with superior flavor, shelf life and nutrient density. Local and regional seed enterprises are responding to market signals by developing vegetables tailored to consumer preferences and climatic conditions.

Water, soil and resource management

Water scarcity and environmental regulation drive adoption of efficient irrigation systems such as drip and precision irrigation. Soil health practices—cover cropping, reduced tillage, and organic amendments—are gaining traction to improve resilience and yield stability. These practices often require upfront investment but can reduce input costs and generate marketable sustainability claims.

High-tech production methods

Controlled environment agriculture (CEA), including greenhouses and vertical farming, expands year-round production with improved resource efficiency. Technology enables reduced water use, minimized pesticide application, and rapid cycles for fresh produce. While capital intensive, CEA offers a path to meet urban demand and supply perishable specialty items with consistent quality, appealing to retailers and consumers focused on freshness and traceability.

Markets and Supply Chains: From Farm Gate to Fork

The transformation of consumption patterns exerts pressure along supply chains. Logistics, cold storage and distribution networks must evolve to preserve quality and reduce losses. Simultaneously, market structures are shifting as retailers, direct-to-consumer platforms and aggregators compete for market share.

Shortening supply chains

Many stakeholders are pursuing shorter, more transparent supply chains to improve freshness and traceability. Farmers’ markets, community-supported agriculture (CSA), and farm-to-table retail arrangements strengthen producer-consumer relationships. These channels often reward producers for quality and storytelling, allowing premiums for locally produced and sustainably managed products.

Role of large retailers and foodservice

Supermarkets and foodservice operators remain major volume drivers. They exert significant influence over standards, pricing and logistics. Retailers increasingly demand standardized packaging, consistent supply, and verified sustainability claims. This creates opportunities for well-organized producer groups but can marginalize smallholders who lack certification or volume.

Cold chain and loss reduction

Investments in cold chain infrastructure lower post-harvest losses and extend shelf life, which is crucial for perishable vegetables. Improved packaging, temperature-controlled transport, and rapid sorting reduce waste and improve market access. These improvements contribute to food security and increase the economic viability of supplying distant urban centers.

Technology, Data and Traceability

Advanced technologies are reshaping how vegetables are produced, marketed and monitored. Digital tools enable better decision-making, improve transparency, and unlock efficiency gains at multiple points along the value chain.

Precision agriculture and sensors

Soil sensors, remote sensing, and drone imagery help farmers optimize fertilizer, water and pest control, increasing yields while minimizing environmental impact. These practices can be framed as part of a producer’s sustainability story, enhancing marketability.

Blockchain and traceability systems

Traceability platforms powered by blockchain or cloud databases provide immutable records of origin, handling and certification. These tools help retailers and consumers verify claims about sustainability, pesticide use and fair labor practices, building trust and enabling premium pricing for verified products.

E-commerce and direct sales

Online marketplaces and subscription services allow smaller producers to reach niche urban consumers directly. Digital marketing and analytics help growers understand demand, plan production cycles, and reduce the unpredictability associated with traditional wholesale markets.

Policy, Finance and Institutional Support

Public policy and institutional frameworks play critical roles in enabling or constraining transitions within vegetable markets. Targeted support can lower barriers to entry for sustainable practices, facilitate infrastructure investment, and protect smallholders from market shocks.

Incentives and regulations

Subsidies, payments for ecosystem services and regulatory standards can accelerate adoption of resource-efficient practices. Conversely, poorly designed policies may entrench unsustainable practices or favor large-scale producers. Policymakers need to balance environmental goals with equity concerns to ensure inclusive market development.

Access to finance

Access to affordable credit and insurance is a major constraint for farmers aiming to invest in technology or diversify crops. Public-private partnerships and blended finance instruments can de-risk investments in cold storage, irrigation, and CEA, especially where returns accrue over multiple seasons.

Extension and capacity-building

Technical assistance, training and farmer networks disseminate best practices in agronomy, post-harvest handling, and market intelligence. Empowering producer organizations enhances bargaining power and facilitates compliance with buyer requirements.

Challenges and Opportunities for Equity and Resilience

While evolving markets create profitability for innovators and well-positioned producers, they also present risks. Market consolidation, certification costs, and technological complexity can exclude smallholders. Building resilient systems means addressing inequality while fostering innovation.

- Improve access to aggregation services so smallholders can meet volume and quality requirements;

- Design affordable certification pathways that recognize incremental improvements in sustainability;

- Invest in shared infrastructure—cold storage, processing hubs, and logistics—to reduce per-unit costs;

- Promote inclusive digital literacy so farmers benefit from market data and e-commerce channels.

Adapting to healthy eating trends does not only mean increasing production of specific crops; it requires rethinking the institutional arrangements that govern access to markets and the distribution of risk and reward. Policies and investments that strengthen local value chains can enhance food sovereignty while meeting consumer demand for fresh, traceable and sustainable produce. For producers willing to innovate and collaborate, these trends offer pathways to higher returns and greater market resilience. At the same time, intentional support is necessary to ensure that the transition benefits a broad cross-section of agricultural communities, not just a few high-tech operators.