The expansion of global trade in fruit, particularly the surge in imports of citrus, is reshaping agricultural markets and testing the adaptive capacity of local producers. Across temperate and tropical regions, domestic growers confront intensified competition from countries with lower production costs, different seasonal windows, or strong export-oriented policies. This article examines the market mechanisms behind rising citrus imports, the direct and indirect effects on farming communities, and practical and policy-oriented responses that can help maintain viable local agrifood systems while meeting consumer demand for year-round access to fresh fruit.

Market dynamics behind growing citrus imports

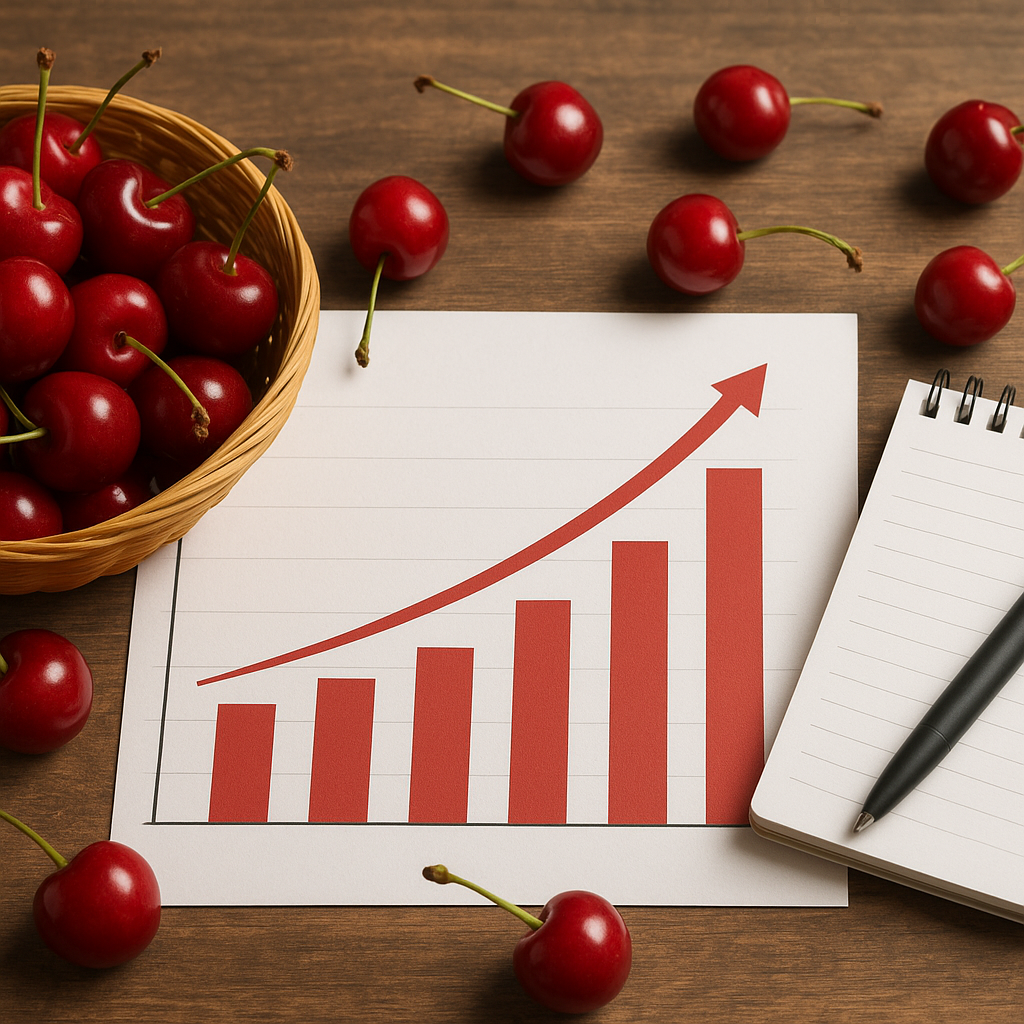

Global demand for fresh fruit has been rising steadily due to urbanization, rising incomes, and a growing health consciousness. Citrus fruit — including oranges, mandarins, lemons, and limes — benefits from strong consumer recognition, long shelf appeal relative to more delicate produce, and well-established shipping practices. Several structural drivers have contributed to expanding imports:

- Seasonality and complementary supply calendars: exporters in the Southern Hemisphere or in different climate zones can supply fruit when domestic production is out of season.

- Economies of scale and specialization: large-scale growers and vertically integrated exporters can achieve lower per-unit costs through mechanization, consolidated packinghouse operations, and specialized logistics.

- Trade liberalization and improved logistics: reductions in tariffs, growth of trade agreements, and better cold-chain infrastructure reduce transit costs and spoilage.

- Retail consolidation and procurement strategies: powerful supermarket chains centralize sourcing to ensure consistent availability and negotiate lower prices, favoring suppliers who can meet strict volume, quality, and certification demands.

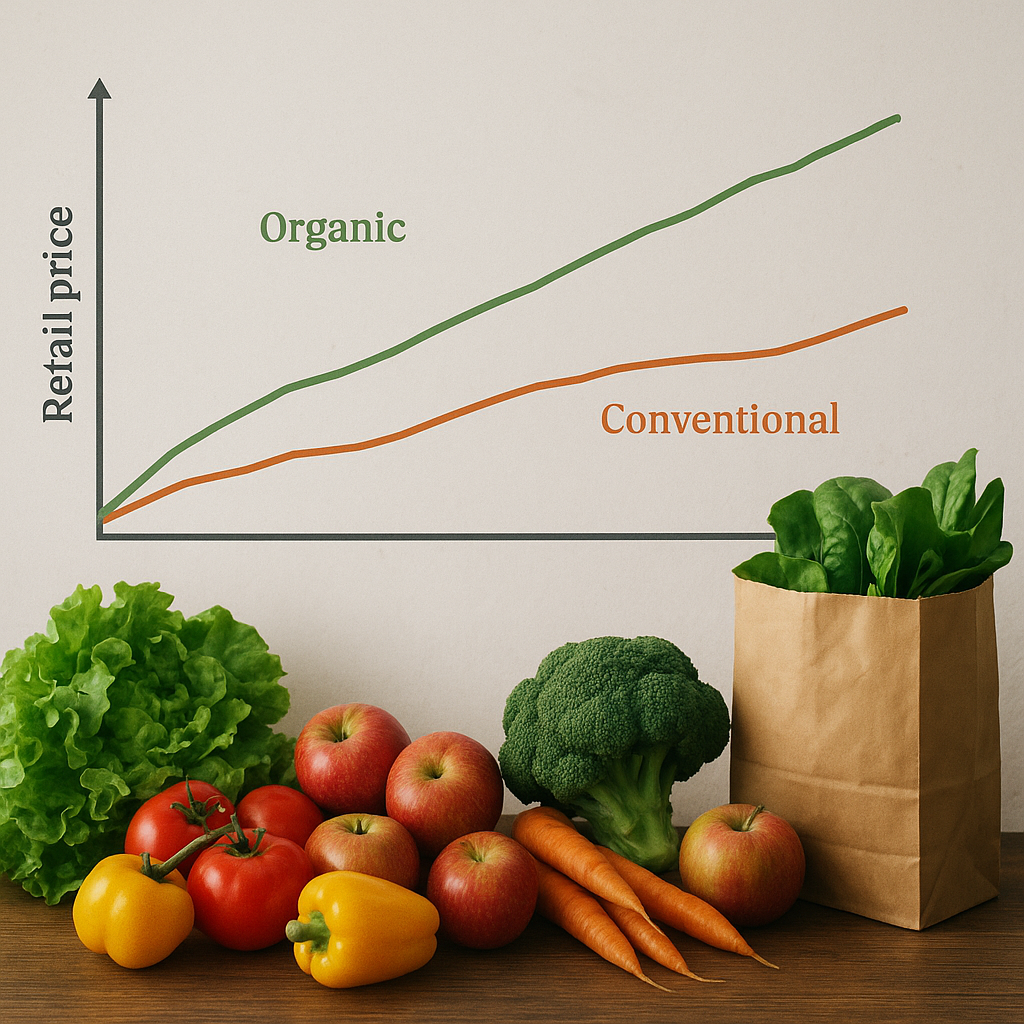

These dynamics alter the price formation process in domestic markets. When imports flood the market during local production windows, they can depress prices, create sharper intra-annual price swings, and alter expectations among growers and buyers. At the same time, imports can expand total consumption by lowering retail prices and widening product variety, which benefits consumers but may squeeze margins for local farmers unless they adopt differentiation strategies.

Impacts on local producers: economic, social, and environmental angles

The impact on local producers is multifaceted. Some farmers experience severe economic pressure, while others find new niches or adapt through cooperation and innovation.

Economic effects

Local farmers often face direct price competition. When imported citrus is cheaper or perceived as more consistent in quality, domestic fruit can be shifted to lower-value channels (processing, juicing) or remain unsold. Key economic consequences include:

- Lower farmgate prices and reduced profitability for growers lacking scale or bargaining power.

- Increased volatility and risk: producers may face unpredictable returns due to price swings and sudden import surges.

- Investment constraints: uncertain returns make it harder for farmers to finance improvements in quality, post-harvest infrastructure, or sustainable practices.

Social and labor impacts

Rural communities dependent on citrus can experience job losses or reduced seasonal employment. Smallholders, contract growers, and laborers are especially vulnerable. The ripple effects may include migration to cities, loss of local know-how, and weakening of rural-based economies. Conversely, some workers may find new opportunities in packing, certification services, or processing if local value chains adapt.

Environmental considerations

The environmental footprint of imported fruit — including transport emissions and differing production practices — complicates sustainability assessments. Local production often has ecological benefits such as shorter transport distances and potential for landscape-scale biodiversity management. However, large-scale local operations can also be intensive in water or agrochemical use. Strengthening sustainable practices among domestic growers can be a competitive advantage, but this requires investment and consumer willingness to pay.

Supply chains, standards, and the role of quality

Imported citrus often enters markets through sophisticated supply chains that emphasize uniform size, color, and shelf life. Retailers and importers demand certifications for food safety, pesticide residues, and increasingly for social and environmental standards. These demands create barriers but also potential avenues for value addition for local producers.

- Compliance with phytosanitary and quality standards is essential to avoid market exclusion and to reduce resilience risks from pests and diseases.

- Traceability systems and third-party certifications (e.g., GlobalGAP, organic labels) can help locally produced citrus command premium prices if producers meet these requirements.

- Cold-chain investments and improved packaging reduce losses and improve the ability of domestic fruit to compete on perceived freshness.

Local producers who invest in differentiation — such as unique varieties, certified organic production, fair-labor practices, or protected geographic indications — can capture niche markets less sensitive to baseline price competition. Cooperative models and farmer-owned packinghouses can consolidate volumes to meet retailer specifications and reduce per-unit costs for certification and logistics.

Policy responses and strategic options for producers

Governments, industry associations, and producers have multiple tools to manage the effects of rising imports while preserving market access and consumer welfare.

Trade and regulatory measures

Trade policy options include selective tariff adjustments, seasonal safeguards, or tariff-rate quotas aimed at smoothing excessive import surges during peak domestic production periods. However, such measures can provoke retaliation, raise consumer prices, and conflict with trade commitments. Non-tariff measures — such as stricter phytosanitary inspections, origin labeling, and enforcement of quality standards — must be applied transparently and in line with international rules to avoid discrimination while protecting biosecurity.

Support for competitiveness and sustainability

Public investments can strengthen the competitiveness of local citrus sectors:

- Subsidies or low-interest loans for post-harvest infrastructure (cold storage, packing lines) and logistics.

- Technical assistance for integrated pest management, water-efficient irrigation, and climate adaptation measures that improve long-term sustainability.

- Support for farmer organizations and cooperatives to improve market access and bargaining power.

Market development and diversification

Domestic producers and governments can pursue market development strategies to expand demand for local fruit through campaigns highlighting freshness, local heritage, or environmental benefits. Value-chain diversification — developing processing industries for juices, concentrates, essential oils, and by-products — can absorb surplus production and add resilience against price shocks.

Opportunities for adaptation at the farm and local level

Local producers have several practical strategies to respond to growing imports. These can be implemented individually or collectively, depending on farm size and market context.

- Varietal selection and innovation: Cultivating niche or high-quality varieties that fetch premiums and are not easily substituted by imports.

- Vertical integration: Forming or joining packinghouses, cold storage facilities, and marketing cooperatives to reduce transaction costs and meet retailer requirements.

- Certification and branding: Obtaining recognized certifications and developing local brands to communicate value to consumers and retailers.

- Contracts and forward sales: Engaging in contractual arrangements with processors or retailers can reduce price risk and secure predictable demand.

- Agroecological practices: Adopting water-saving irrigation, soil health improvements, and integrated pest management to reduce input costs and appeal to eco-conscious consumers.

Concluding observations on balance and long-term perspectives

Growing citrus imports are neither an unambiguous threat nor a uniform opportunity; their effects depend on local conditions, policy frameworks, and the adaptive capacity of agricultural systems. Well-targeted investments in quality, post-harvest infrastructure, and cooperative organization can help domestic growers maintain viable livelihoods and capture value beyond bulk commodity markets. At the same time, transparent trade policies and strong phytosanitary management are necessary to protect domestic producers from unfair competition and to safeguard public goods like plant health.

Ultimately, a resilient citrus sector will combine market-oriented adaptation — including product differentiation, improved supply chains, and access to finance — with public measures that support innovation and equitable transitions. With coordinated action across growers, buyers, and policymakers, local producers can find pathways to thrive even as the global circulation of fruit intensifies.