The trajectory of tropical fruit consumption in Europe reflects a complex interplay of agricultural production, international trade, consumer preferences, and policy frameworks. As demand for exotic flavors rises, European markets are adapting to new supply models, while producers and retailers confront challenges related to sustainability, traceability, and food safety. This article examines the evolving landscape of tropical fruit markets in Europe, considering economic drivers, production and logistics, consumer behavior, regulatory impacts, and future opportunities for both exporters and domestic stakeholders.

Market dynamics and trade flows

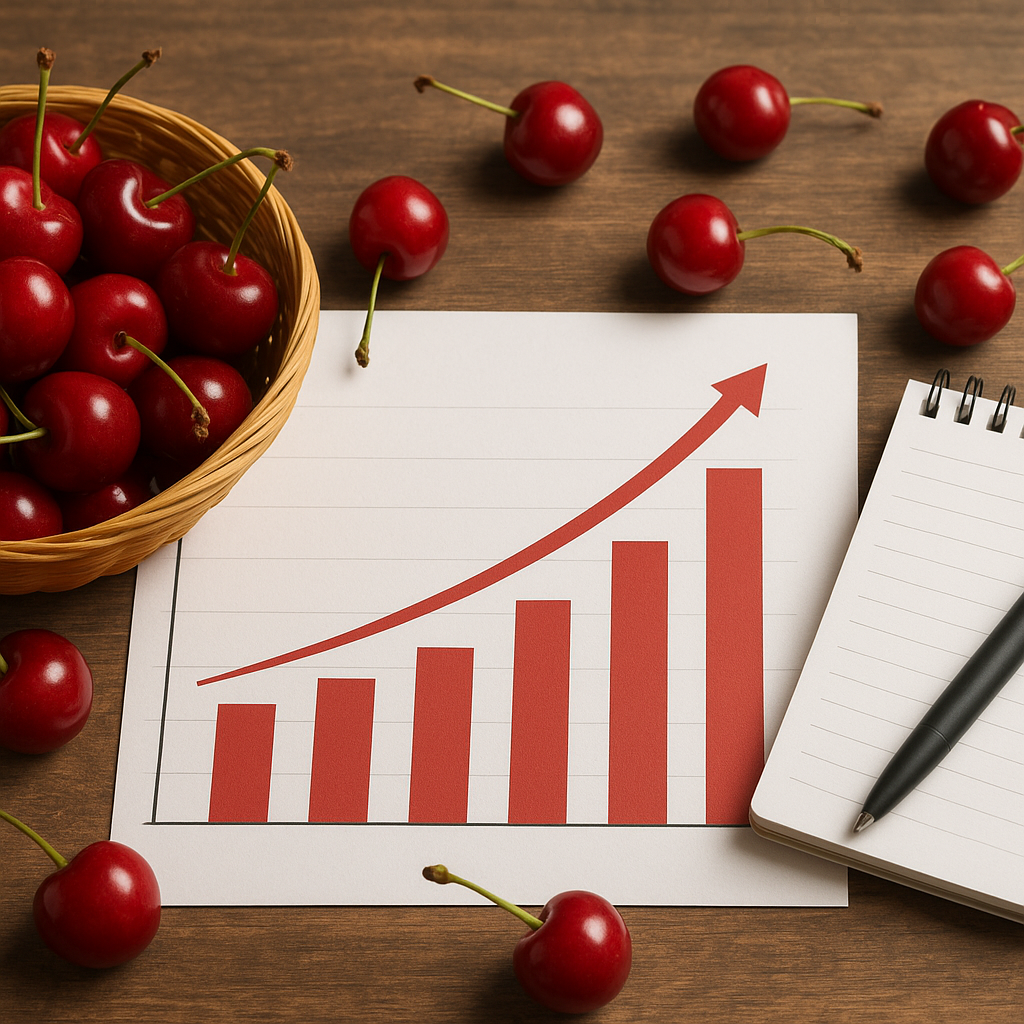

European consumption of fruits like bananas, pineapples, mangoes, avocados, and more niche items such as papayas and rambutans has grown steadily over recent decades. Much of this growth is driven not only by changing consumer tastes but also by improved distribution networks and retail strategies. The market structure is shaped by a few interrelated factors:

- Rising disposable incomes and urbanization favoring demand for fresh, convenient produce.

- Seasonality management through imports that smooth year-round availability.

- Retail consolidation in many countries, which concentrates purchasing power and affects supplier contracts.

Trade flows remain dominated by long-established exporters in Latin America, Africa, and Southeast Asia. Bananas, still the most consumed tropical fruit, are largely sourced from specialized plantations in Central and South America and West Africa. However, the diversity of the tropical fruit basket is expanding: European consumers now expect a broader range of varieties, driving new trade lanes and seasonal sourcing strategies. This trend is encouraging exporters to invest in quality improvement, post-harvest handling, and packaging innovations to meet retailer specifications.

Production systems, sustainability and rural development

Production of tropical fruits for the European market occurs both in export-oriented farms abroad and, in a limited way, in protected cultivation within Europe. Key themes for production systems include climate change adaptation, labor management, and integration of sustainable practices. For many producing countries, tropical fruit exports are important drivers of rural employment and foreign exchange earnings.

Export production models

- Large-scale plantations provide economies of scale and standardized quality but often raise concerns over monoculture, pesticide use, and social conditions.

- Smallholder-dominated supply chains require aggregation and investment in post-harvest infrastructure to comply with European standards and certification schemes.

Efforts to improve sustainability are visible through certifications (Fairtrade, Rainforest Alliance, GlobalG.A.P.) and private-sector initiatives focusing on reduced chemical inputs, water management, and better labor practices. European buyers increasingly demand evidence of sustainable production, shifting purchasing toward suppliers that can demonstrate environmental stewardship and community benefits. This movement creates incentives for capacity-building projects that link farm-level improvements with market access.

Supply chains, logistics and value chains

Moving delicate tropical fruits across long distances requires sophisticated logistics. Cold chain integrity, ripening control, and efficient customs procedures are essential to deliver high-quality produce to European shelves. The expansion of air and sea freight options, along with innovative packaging that extends shelf life, has enabled new varieties to reach consumers.

Challenges and innovations

- Maintaining cold chain from farm to retailer to prevent spoilage and protect product value.

- Investment in packhouse facilities for sorting, ethylene management, and controlled ripening.

- Use of digital tools for logistics optimization and real-time monitoring of shipments.

Traceability technologies, including blockchain pilots and QR-coded labeling, are gaining traction as consumers and regulators demand more information about origin, production practices, and carbon footprints. Such transparency supports premium pricing for verified products, but also requires investments by suppliers and intermediaries to integrate new systems.

Consumer trends and segmentation

European consumers are diverse in preferences, with segments that range from budget-conscious shoppers to health-focused and environmentally aware buyers. Several trends impact tropical fruit consumption:

- Health and wellness narratives boost demand for fruits perceived as nutrient-dense — for example, avocado and mango have benefited from superfood positioning.

- Convenience-oriented products, such as pre-cut fruit and ready-to-eat packaging, attract urban consumers seeking instant consumption options.

- Ethnic and culinary curiosity drives interest in less familiar tropical items, supporting niche markets in specialty stores and restaurants.

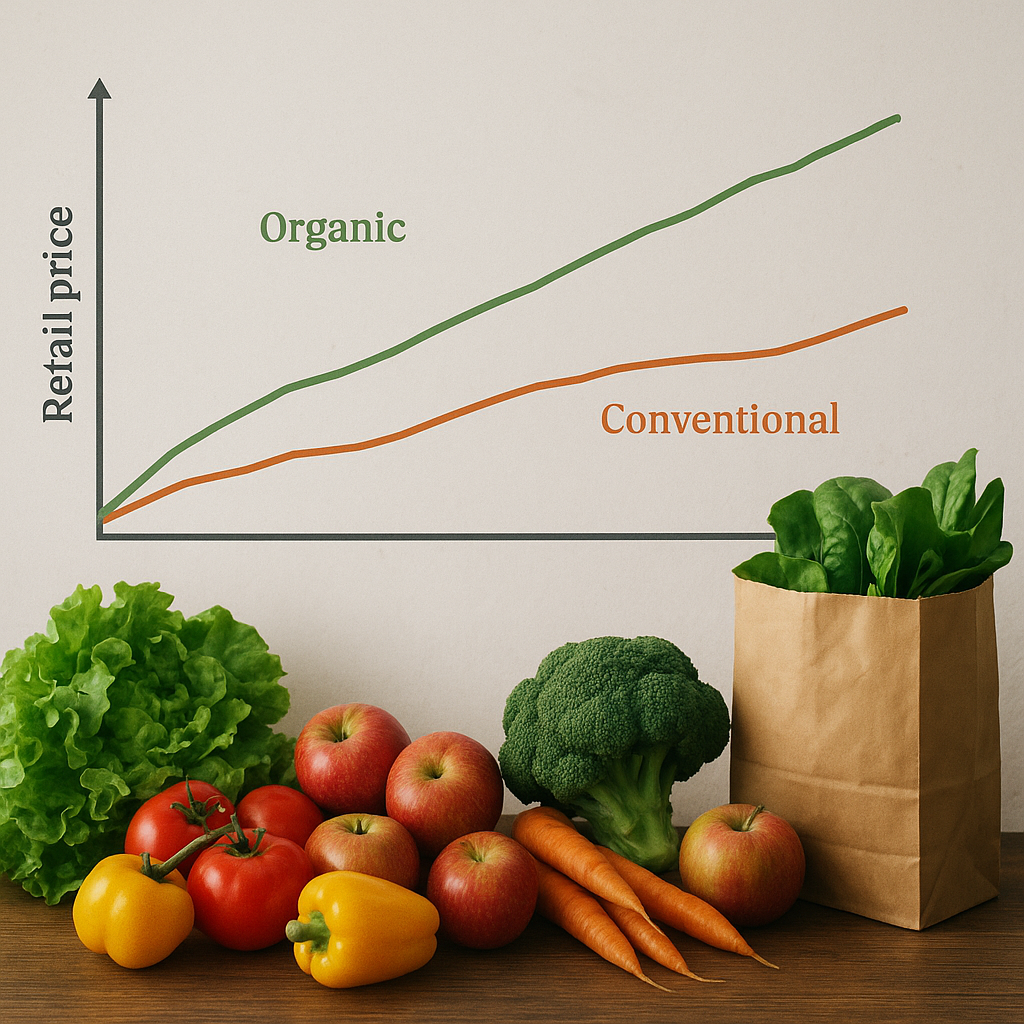

Price sensitivity remains important, especially in mass retail segments. Affordability pressures can conflict with sustainability goals, creating a dual challenge: how to make responsibly produced fruits accessible while maintaining producer margins. Retailers use private labels and promotional strategies to balance these forces, while foodservice channels often value uniqueness and quality over price alone.

Regulatory environment and trade policy

European standards on food safety, pesticide residues, and phytosanitary requirements shape the ability of suppliers to access markets. Compliance with Maximum Residue Levels (MRLs) set by the European Food Safety Authority (EFSA) is non-negotiable for exporters. Additionally, import controls and certification requirements can add transaction costs and logistical delays.

Impact of tariff and non-tariff measures

- Preferential trade agreements can lower tariff barriers for certain suppliers, creating competitiveness shifts.

- Non-tariff measures — including sanitary and phytosanitary standards — often require technical assistance for exporting countries to meet compliance.

Policy trends within the EU, such as the European Green Deal and initiatives on reducing food waste, also affect tropical fruit markets. For example, incentives to cut food loss encourage better ripening and distribution practices, while sustainability reporting requirements push companies to disclose supply chain impacts.

Innovation, research and development

Innovation occurs across cultivation, post-harvest processing, and retail. Breeding programs aim to develop varieties with improved shelf life, disease resistance, and flavor profiles suited to European palates. Post-harvest technologies that extend freshness reduce waste and open new commercial windows for exporters.

- Research into low-impact pest management and integrated pest management (IPM) systems supports reduced chemical use while maintaining yields.

- Biodegradable and modified-atmosphere packaging solutions address both shelf-life and environmental concerns.

- Data-driven approaches, including predictive analytics for ripening and demand forecasting, help align supply with consumption patterns.

Collaboration between universities, private sector actors, and international development agencies accelerates adoption of technical solutions. Funding priorities increasingly favor projects that demonstrate both economic viability and environmental or social benefits.

Regional strategies and opportunities within Europe

While most tropical fruits are imported, certain regions in Southern Europe and the Mediterranean are experimenting with off-season or greenhouse production of subtropical species. This local production can reduce transport emissions and offer fresher products, though climatic limitations and scale constraints persist.

Value-added and circular approaches

- Processing of surplus or lower-grade fruits into juices, purees, and dried products adds value and reduces waste streams.

- Circular economy initiatives, such as using fruit by-products for animal feed or bioproducts, create additional income for supply chains.

Retailers and brands that emphasize local sourcing for available subtropical lines can differentiate on freshness and carbon intensity, appealing to consumers who prioritize shorter supply chains. At the same time, the exotic appeal of true tropical fruits remains a strong market driver.

Risks, resilience and future scenarios

Multiple risks could reshape tropical fruit consumption in Europe. Climatic shocks in producing regions, geopolitical disruptions affecting shipping routes, and abrupt shifts in consumer sentiment toward or away from particular commodities can all impact supply and prices. Building resilient systems means diversifying sourcing, investing in producer capacity, and strengthening logistical networks.

- Scenario planning suggests that diversification of supplier countries and varieties will mitigate single-source dependency.

- Investment in local processing facilities near production zones buffers against transport disruptions.

- Public-private partnerships can fund adaptation projects that secure long-term supply while supporting local livelihoods.

Ultimately, the future of tropical fruit consumption in Europe will hinge on balancing consumer expectations with ethical sourcing and environmental constraints. Stakeholders across the value chain — from smallholder farmers to multinational retailers — must collaborate to align incentives for quality, fairness, and resilience. The coming decade offers opportunities to transform how tropical fruits are produced, traded, and enjoyed across European markets, provided that innovation and policy move in tandem with market demand.