The spread of regenerative farming approaches is reshaping how agricultural systems are managed and how global commodity markets function. By prioritizing soil health, enhancing biodiversity, and seeking to capture carbon in the landscape, farmers and buyers are redefining value beyond simple yield metrics. This article examines the agronomic principles behind regenerative agriculture, the practical effects on commodity production and quality, and the broader implications for market structure, pricing, and supply chains.

Principles and Practices of Regenerative Farming

At its core, regenerative agriculture focuses on restoring and enhancing natural processes that support productive farming systems. Common practices include reduced or no-till cultivation, diverse crop rotations, cover cropping, managed grazing, agroforestry, and the integration of perennials. The objective is to boost ecological functions that sustain long-term productivity.

Key ecosystem services targeted by these practices are improved soil structure and fertility, increased water infiltration and retention, pest and disease regulation, and greater habitat complexity for beneficial organisms. These services support greater farm-level resilience to weather shocks and reduce reliance on external chemical inputs.

Adoption is often supported by a combination of knowledge transfer, on-farm experimentation, and targeted investments. Farmers switching to regenerative systems can face a transition period during which yields and cash flows may fluctuate. Nevertheless, many growers report improvements in system stability and resource-use efficiency over time.

Production Effects: Yields, Quality, and Risk

One of the central debates about regenerative agriculture concerns its effect on commodity output. Short-term yield impacts depend on previous management, climate, and the specific practices implemented. In many cases there is an initial dip in productivity as soil biology and fertility pathways reestablish, followed by stabilization or improvement.

Beyond tonnage, regenerative practices can influence crop and livestock quality. For example, better soil health can enhance nutrient density in crops and improve forage quality for livestock, affecting both marketability and end-consumer benefits. This shift creates opportunities for producers to seek price premiums through differentiated products or value-added branding.

Risk profiles also change. Farms with healthy soils and diversified rotations tend to show lower sensitivity to drought and extreme rainfall events. Managing risk through on-farm practices can reduce the need for costly insurance or mitigating inputs, altering producers’ cost structures and competitive dynamics within commodity sectors.

Market Signals and Price Formation

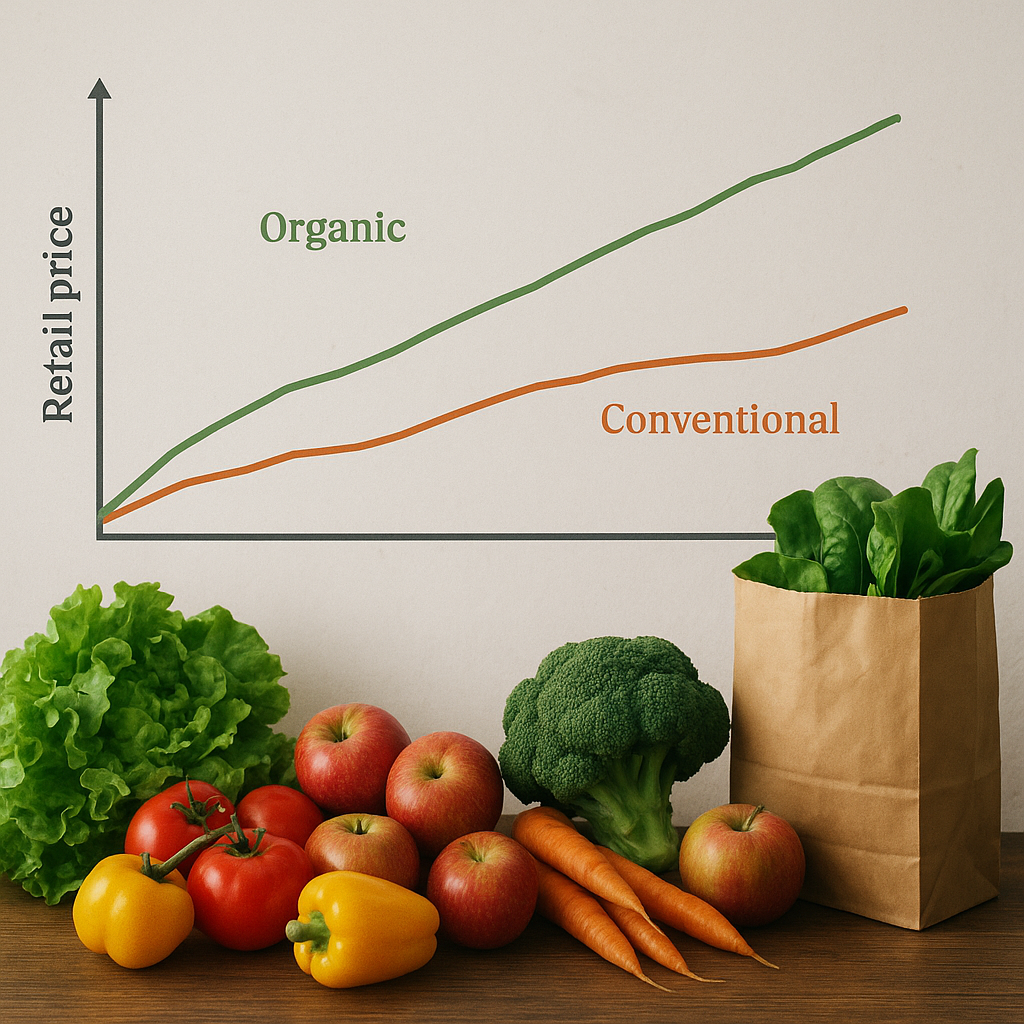

Commodity markets have traditionally been driven by aggregated supply-demand signals, weather forecasts, and macroeconomic trends. The rising prevalence of regenerative methods introduces new, more heterogeneous supply characteristics that can affect price formation.

- Segmentation: Markets may split into conventional and regenerative supply streams. Buyers seeking traceability and sustainability attributes will pay different prices, leading to supply chains that are increasingly specialized.

- Premiums and contracts: Off-take agreements, certifications, and sustainability-linked premiums can create predictable revenue streams for regenerative producers, altering futures hedging and basis relationships for those commodities.

- Volatility: Greater resilience at the field level can dampen some weather-driven production shocks, potentially smoothing seasonal supply swings. However, if adoption is uneven, localized shortages or surpluses could increase short-term volatility for specific market segments.

Market participants, from processors to traders, are beginning to price in these attributes. For commodities where traceability and quality attributes command value — such as coffee, cocoa, and specialty grains — regenerative practices can be a meaningful differentiator. For bulk staples, the effect is subtler but growing as corporate sustainability commitments drive procurement strategies.

Supply Chain Transformation and Institutional Drivers

Large food companies, retailers, and institutional buyers are major drivers of regenerative adoption through procurement policies and sustainability targets. Public commitments to reduce supply-chain emissions and improve environmental outcomes create demand for agricultural systems that sequester carbon and restore ecosystems.

Two mechanisms are particularly influential:

- Certification and verification programs that quantify regenerative outcomes and enable market differentiation.

- Payments for ecosystem services, including carbon markets and biodiversity credits, which provide additional revenue streams for producers implementing regenerative practices.

These mechanisms require robust measurement, reporting, and verification (MRV) systems. Advances in remote sensing, soil testing, and farm-level data platforms are facilitating MRV, but challenges remain around baseline setting, permanence, and co-benefit accounting. Institutional buyers are increasingly integrating regenerative criteria into long-term supplier contracts, shaping incentives across landscapes.

Policy, Finance, and Scaling Adoption

Public policy can accelerate or hinder scaling regenerative practices. Direct subsidies, technical assistance programs, and landscape-level conservation schemes reduce barriers to adoption. Conversely, policies that favor monoculture intensification or provide subsidies tied exclusively to input use can impede transitions.

Financial instruments tailored to the transition can make a difference. Examples include low-interest loans for equipment that supports cover cropping or no-till, outcome-based payments for carbon sequestration, and blended finance that shares the risk of early adoption. Investors and lenders are beginning to assess farms’ regenerative performance as part of credit risk evaluation.

Scaling requires attention to social and economic equity. Smallholders and resource-constrained farmers often face higher relative costs to change cropping systems or invest in new machinery. Ensuring access to finance, extension services, and markets is essential for equitable adoption, especially in developing-country contexts where commodity production supports livelihoods.

Challenges, Measurement, and Market Integrity

Despite potential benefits, several obstacles complicate the relationship between regenerative agriculture and commodity markets.

Measurement and attribution

Quantifying on-farm improvements in soil carbon, water retention, and biodiversity at scale is technically complex. Short-term proxy indicators can misrepresent long-term outcomes. Reliable MRV systems are critical to prevent greenwashing and to ensure that market premiums reflect genuine environmental gains.

Standardization and certification

Diverse definitions of regenerative practices across certifiers and programs can fragment markets. Consistent standards help build buyer trust and enable mainstreaming, but they must be flexible enough to account for region-specific agroecological realities.

Economic incentives and market access

For regenerative systems to thrive, farmers need assured pathways to market and fair compensation for ecosystem services. Without transparent pricing signals and accessible value chains, adoption may remain limited to pioneers and niche producers, constraining the potential systemic impact on global commodity flows.

Opportunities for Traders, Processors, and Policymakers

Stakeholders across the agrifood system can benefit from engaging constructively with regenerative transitions.

- Traders and processors can develop vertically integrated supply chains that lock in regenerative-sourced commodities, capture value from premiums, and manage reputational risk.

- Buyers and brands can differentiate products with verified environmental credentials, appealing to consumers seeking sustainably produced foods.

- Policymakers can design incentive structures — including public procurement policies and carbon pricing — that direct finance toward regenerative outcomes, supporting landscape-scale adoption.

Strategic investments in farmer training, cooperative structures, and technology platforms that streamline data collection will accelerate learning and reduce transaction costs. These interventions help bridge the gap between on-farm ecological improvements and market recognition.

Conclusion: Market Evolution without a Final Summary

The shift toward sustainability in agriculture is not a uniform transition but a mosaic of practices and market responses. As regenerative approaches gain traction, their influence on commodity markets will depend on the pace of adoption, the effectiveness of MRV systems, and the ability of value chains to compensate producers for broader environmental benefits. The interplay of farm-level ecology, market incentives, policy frameworks, and consumer demand will determine whether regenerative agriculture remains a niche strategy or becomes a material force in global commodity dynamics.