Agriculture and agricultural price analysis are critical components of the global economy, influencing food security, trade policies, and the livelihoods of millions of people worldwide. Understanding the dynamics of agricultural markets and the factors that drive price changes is essential for policymakers, farmers, and consumers alike. This article delves into the intricacies of agriculture and agricultural price analysis, exploring the various elements that impact these markets and the methodologies used to analyze them.

Chapter 1: The Dynamics of Agricultural Markets

Agricultural markets are complex systems influenced by a myriad of factors, including weather conditions, technological advancements, government policies, and global trade dynamics. These markets are characterized by their volatility, with prices often fluctuating due to changes in supply and demand, geopolitical events, and environmental factors.

1.1 Supply and Demand Factors

The fundamental forces of supply and demand play a crucial role in determining agricultural prices. On the supply side, factors such as crop yields, input costs, and technological innovations can significantly impact the availability of agricultural products. For instance, a bumper harvest due to favorable weather conditions can lead to an oversupply, driving prices down. Conversely, poor weather conditions or pest infestations can reduce supply, leading to higher prices.

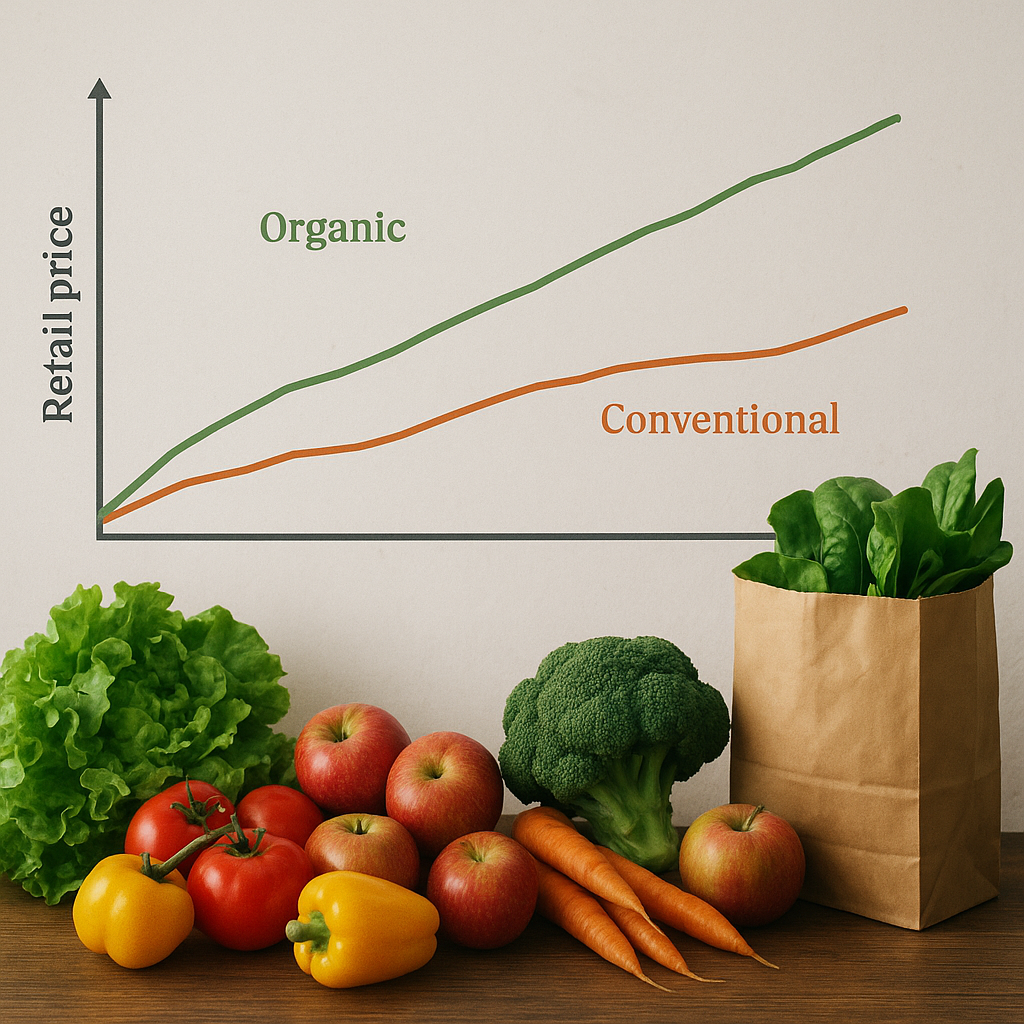

Demand for agricultural products is influenced by population growth, income levels, dietary preferences, and global trade patterns. As populations grow and incomes rise, the demand for food, particularly high-value products like meat and dairy, increases. Additionally, changes in consumer preferences, such as a shift towards organic or plant-based foods, can also impact demand dynamics.

1.2 Government Policies and Trade Agreements

Government policies and trade agreements are significant determinants of agricultural prices. Subsidies, tariffs, and import/export restrictions can alter the competitive landscape, affecting both domestic and international markets. For example, subsidies for certain crops can lead to overproduction, resulting in lower prices. On the other hand, tariffs on imported goods can protect domestic producers but may lead to higher prices for consumers.

Trade agreements, such as the North American Free Trade Agreement (NAFTA) or the European Union’s Common Agricultural Policy (CAP), can facilitate or hinder the flow of agricultural products across borders. These agreements often aim to reduce trade barriers, promote market access, and ensure fair competition, ultimately influencing price stability and market efficiency.

1.3 Technological Advancements

Technological advancements have revolutionized agriculture, enhancing productivity and efficiency. Innovations such as precision farming, genetically modified organisms (GMOs), and advanced irrigation systems have enabled farmers to increase yields and reduce costs. These advancements can lead to changes in supply dynamics, impacting agricultural prices.

Moreover, technology has improved market transparency and access to information, allowing farmers and traders to make more informed decisions. Digital platforms and data analytics tools provide real-time market insights, helping stakeholders anticipate price movements and optimize their strategies.

Chapter 2: Methodologies for Agricultural Price Analysis

Analyzing agricultural prices requires a comprehensive understanding of market dynamics and the application of various analytical tools and techniques. Price analysis helps stakeholders identify trends, assess risks, and make informed decisions. This chapter explores some of the key methodologies used in agricultural price analysis.

2.1 Time Series Analysis

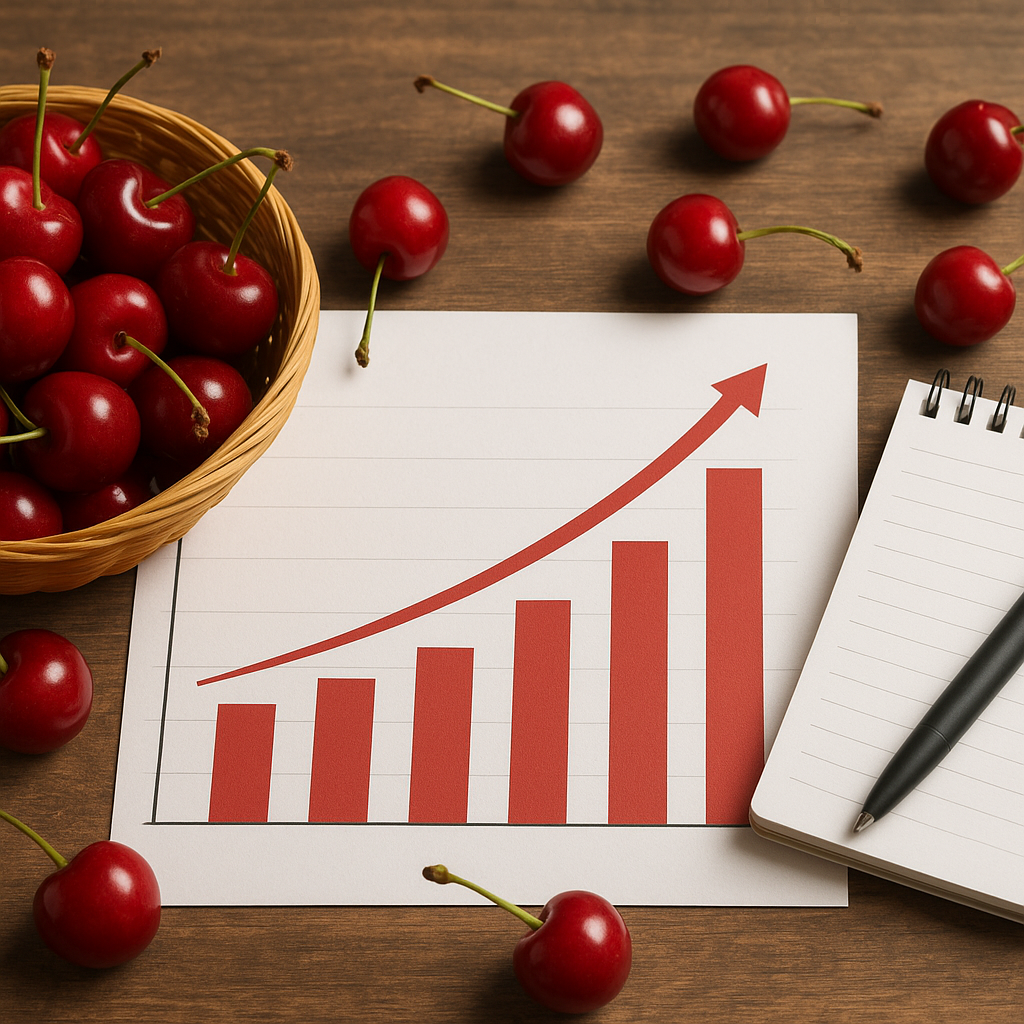

Time series analysis is a statistical technique used to analyze historical price data and identify patterns or trends over time. This method involves examining price movements at regular intervals, such as daily, monthly, or yearly, to forecast future prices. Time series analysis can help identify seasonal patterns, cyclical trends, and long-term price movements.

Common techniques used in time series analysis include moving averages, autoregressive integrated moving average (ARIMA) models, and exponential smoothing. These methods allow analysts to capture underlying trends and make predictions based on historical data.

2.2 Econometric Modeling

Econometric modeling involves the use of statistical and mathematical models to analyze the relationships between agricultural prices and various economic factors. This approach helps identify causal relationships and quantify the impact of different variables on price movements.

Econometric models can incorporate a wide range of factors, including supply and demand variables, input costs, exchange rates, and policy changes. By estimating the coefficients of these variables, analysts can assess their significance and predict how changes in these factors may influence prices.

2.3 Market Simulation and Scenario Analysis

Market simulation and scenario analysis are powerful tools for exploring potential future outcomes and assessing the impact of different scenarios on agricultural prices. These methods involve creating hypothetical market conditions and analyzing how prices would respond to changes in supply, demand, or policy variables.

Scenario analysis can help stakeholders evaluate the potential effects of climate change, trade disruptions, or policy interventions on agricultural markets. By simulating different scenarios, analysts can identify potential risks and opportunities, enabling more informed decision-making.

2.4 Price Transmission and Market Integration

Price transmission and market integration analysis examine how price changes in one market or region affect prices in another. This approach is particularly relevant in the context of globalized agricultural markets, where price movements in one country can have ripple effects across the world.

Understanding price transmission mechanisms helps identify the degree of market integration and the extent to which prices are influenced by external factors. This analysis can provide insights into the efficiency of markets and the effectiveness of trade policies.

In conclusion, agriculture and agricultural price analysis are vital components of the global economy, influencing food security, trade policies, and the livelihoods of millions. By understanding the dynamics of agricultural markets and employing various analytical methodologies, stakeholders can make informed decisions, mitigate risks, and capitalize on opportunities in this ever-evolving sector.